Very recently, India finally conducted some surgical strikes on terror cells in Pakistan. This was a historic event in the history of India as India has never been an aggressor in its past. Because of years of cross border terrorism conducted by Pakistan sponsored terror cells, India has finally given a strong reply to Pakistan.

While opting for diplomatic options like past has been an absolute waste of time as Pakistan does not have a democracy which caters to the civilians but democracy in Pakistan caters to its military. Hence, There is no use in trying diplomacy with Pakistan and India also did a good job by boycotting the SAARC ( South Asian Association for Regional Cooperation ) summit in Islamabad. The countries in South Asia who supported India’s boycott included Afghanistan, Sri Lanka, Bangladesh, Myanmar and Maldives.

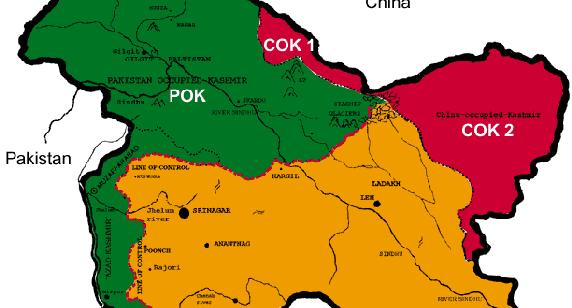

It is to be noted that China has not openly condemned Pakistan for operating terror cells although these terror cells also train militants from China’s Uighur province. China has not only purchased COK 1 Region from above image from Pakistan but is also making huge investments for making an economic corridor with rest of Asia. As India is moving closer to Washington, Pakistan is moving closer to Beijing. This is escalating the geo-political tensions further and it is a matter of time that this conflict at the Line of Control (LOC) would become a proxy war between Washington and Beijing.

If India wants to succeed in declaring Pakistan as a terror sponsoring nation and for world community to pressure Pakistan from banning its terror cells operate in its country, India has to be able to balance the military actions of Pakistan and manage its diplomacy with China. Without balancing its diplomacy with China, India risks going on a war with China along-with Pakistan, which would lead to loss of many lives along-with a loss of huge fortune. Besides, India also needs an approval from China to become part of NSG (Nuclear Suppliers Group).

India can ensure good diplomatic relations with China by means of carrying out a bilateral trade with China. The present trade policies of India are to stop the dumping of goods by China into Indian market. While these policies are necessary to control India’s trade deficits with China, they are certainly not improving India’s relations with China as a good trading partner. I was recently invited by a television channel based in Mumbai to give my opinion about Indian foreign Policy with its closeness to Washington where I had suggested that India needs to build itself first as an economic and financial power rather than a military power.

A day before India carried out its surgical strikes on terror camps in Pakistan, I was invited as a geo-political analyst and macro-economist to analyze the speech by Indian Minister of Foreign Affairs, Smt. Sushma Swaraj, at the UN. Also,We discussed about India’s future strategies w.r.t. Pakistan. As I had mentioned, Pakistan does not understand diplomacy because the elected Prime Minister in Pakistan is answerable to the Military Generals first and then to the people of Pakistan. Hence, India has to make use of military options when dealing with Pakistan. However, I discussed about the tackling the threat of China and a scenario where Washington might not be in a position to help India due to ongoing economic crisis in United States. Hence, India has to have good diplomatic relations with China when dealing with Pakistan.

I also mentioned about using help of the Reserve Bank of India (RBI) to improve India’s diplomatic relations with China over coming years. Let me explain subsequently how is that possible. In order to avoid trade deficits from dumping of Chinese goods, India opted for imposing an import duty on them to make its domestic goods competitive. While this helps protect India’s domestic manufacturing sector from an unfair competition from cheap Chinese goods entering the country and destroying India’s economy, it does not help boost India’s exports to China. Any trade has to be bidirectional so that it can build up healthy relations between two countries. Presently, India runs huge trade deficits with China and those deficits are high w.r.t. electronic goods that are imported from China. These trade deficits result in local unemployment in India and also puts a strain on Indian economy. India has to be able to balance for these deficits by means of running a trade surplus with China.

With today’s exchange rate between Indian Rupee (INR) and Chinese Yuan (RMB),

1 RMB = 10 INR

Hence, For a product manufactured in India for INR 100 (10 RMB), Indian merchants can make a decent profit by exporting the produce to Chinese buyers for INR 125 ( 12.5 RMB). However, If there is an import duty imposed by China then Indian goods would become expensive in China and China’s goods would become expensive in India when India imposes and import duty on them. Hence, Rather than having a bidirectional trade between the two countries, such policies can also contribute to decrease in trade between two countries.

Chinese Central Bank manipulates exchange rates and hence it does not follow true free trade with world, as a signatory with the WTO. Hence, Chinese goods are comparatively cheaper in all countries which lets China run a trade surplus with all its trading partners.

India’s imports from China = China’s imports from India + China’s purchase of Indian government bonds

Hence, With its trade policies China is able to buy India’s debt by purchasing Indian government bonds and run a trade surplus with India. If RBI also follows such policies so that

India’s exports to China + India’s purchase of Chinese government bonds = China’s imports from India

There will be a jump in Indian exports to China and jump in Chinese exports to India. This is because RBI will pursue competitive devaluation by manipulating its exchange rate so that RBI can offer products to Chinese consumers at an exchange rate of 7 INR for 1 RMB , if that does not help then RBI could change the rate to 5 INR for 1 RMB. In this way, Indian government will hold Chinese debt and Chinese government will hold Indian debt. Additionally, With both countries exporting its goods will mutually benefit both economies.

Since, India will withhold Chinese debt and China will withhold Indian debt, this will eliminate the chances of a military conflict between two countries in future and increase the economic solidarity of the two nations. This way, India can completely isolate Pakistan without being worried about Chinese support as China will never dare to invade India due to India’s ownership of China’s sovereign debt. Additionally. China will also not be able to oppose India’s bid for NSG membership. This trade policy will enhance interests of not only India and China but also ease the tensions along the LOC and help pressurize Pakistan to eliminate its terror cells.

About the Author

Apek Mulay is Business and Technology Consultant at Mulay’s Consultancy Services. He is also a senior analyst and macroeconomist in US Semiconductor Industry. He is author of book “Mass Capitalism: A Blueprint for Economic Revival“. This book is available to be ordered as an autographed copy by the author on this blog. His first book was released nationwide in USA on 17 October 2014 and is available in e-book format as well. Mass Capitalism in Marathi language will be available for readers from Maharashtra, India in 2017. Please read book reviews from several experts across the world by clicking here. Mulay has also authored another book “Sustaining Moore’s Law: Uncertainty Leading to a Certainty of IoT Revolution” with Morgan & Claypool available for purchase at Morgan & Claypool retail site. Mulay’s third volume with Business Expert Press Publications is entitled “How Information Revolution Remade the Business and the Economy : A Roadmap for Progresss of the Semiconductor Industry“. He has also authored a monograph on technology with Lambert Academic Publishing entitled “Improving Reliability of Tungsten Plug Via on an Integrated Circuitry: Process Flow in BiCMOS and CMOS Technology with Failure Analysis, Design of Experiments, Statistical Analysis and Wafer Maps“. www.apekmulay.com

Recent Comments