By Apek Mulay ‚ and Dhanjoo Ghista

Summary:‚ The process of offshore outsourcing of manufacturing has disrupted the supply chain of the US electronics and semiconductor (ELSC) industry. This opportunistic capitalism on the part of MNCs has caused (i) micro-economic fall-outs due to the unemployment of former workers of MNCs that moved manufacturing abroad, as well as (ii) macro-economic disasters due to decreased exports and increased (duty-free) imports, thereby increasing trade imbalances and deficits and affecting the market value of the US dollar. For ELSC industrial revival, we are proposing economic reforms towards‚ back-shoring‚ companies to low cost-of-living rural areas, by means of (i) favorable tax policies, (ii) establishing more rural educational institutions with grassroots support to provide technological support to the industry, and (iii) effecting cooperative ownership of companies¢‚¬„¢ assets (in the form of shares) by its employees, resulting in the economy automatically coming within the control of the 99% Americans, towards the realization of the All American Dream.

Introduction: Quo Vadis the US Electronics and Semiconductor Industry

One of the important causes of the loss of global dominance of the US Manufacturing Industry and in particular the Electronics and Semiconductor Industry is the Trade Liberalization Policies, which have permitted US-headquartered Multi-National Corporations (MNCs) to establish manufacturing bases in Low Labor Cost (LLC) countries. This process of offshore outsourcing has resulted in distorted Supply chain of electronics and semiconductor goods. It all started with MNCs increasing their influence in the trade agreements, such as General Agreement on Tariffs and Trade (GATT) and later World Trade Organization (WTO), in order to increase market share by promoting a deceptive practice of “Free Trade” by lowering and abolishing trade barriers between member countries including the United States. Such an Opportunistic Capitalism on the part of MNCs has caused (i) micro-economic fall-outs due to the unemployment of former workers of these MNCs (that moved manufacturing abroad), as well as (ii) macro-economic disasters due to decreased exports and increased (duty-free) imports, thereby enhancing trade imbalances & deficits. It has also affected the market value of the USD. Additionally, Distorted Supply chain has also been one of the primary causes of counterfeit electronics entering into US Supply chain from LLCs. Counterfeit ICs not only result in malfunctioning of modern electronics but also eat significant portions of profits from semiconductor companies‚ [5][14].

In order to backshore and insource US manufacturing jobs and restore the legitimacy of Supply chain due to outsourcing offshore, incentives have to be offered to bring manufacturing to US rural areas (having much lower cost-of-living relative to cities) and thereby making them competitive in relation to the Low Labor Cost (LLC) countries, through capital grants, lower tax rates, tax holidays, etc. Also, by setting up more rural universities and effecting a mutually benefitting collaboration between the rural universities and industries, the costs for R&D can be reduced. Furthermore, an altered co-operative structure for companies, with employees involved in company management decisions and sharing company profits would enable companies to address home needs and also benefit their employees to thereby enhance consumer purchasing capacity and demand; this would result in the growth of our overall economy‚ [2]. When employees become owners they would not offshore manufacturing to LLCs if this process has proven long term problems to US economy. Having electronics manufactured domestically in rural areas would not only eliminate trade deficit but by creating more jobs would also increase the tax revenues reducing the budget deficit. In this way, National Debt could also be retired over time. These solutions can help to rejuvenate the US Electronics and Semiconductor industry, restore prosperity for the working class Americans and also preserve the incentive for hard work. So, let us analyze each of the above proposed economic reforms towards revival of US Electronics and Semiconductor industry.

US Semiconductor Business Operations: What caused Offshoring of Manufacturing and Counterfeit Electronics entry into US

The original intention of American corporations to establish their operations abroad was to gain market share and to increase their profits. In this endeavor, the Wall Street played a very important role of forcing the shifting of the manufacturing bases from US to LLCs, in order to promise multi-million dollar returns to investors. In its business model, Wall Street has to promise high returns to its investors and it really does not matter if this also means selling America to other countries. The semiconductor companies in US like Texas Instruments, IBM, AMD, Intel, etc. were manufacturing high quality products; there was proximity of labs and fabs, and they were hence called Integrated Device Manufacturers (IDMs). There was no counterfeiting of electronics by any US corporation due to stringent Patent Infringement laws and protected Intellectual Property (IP) as a result of compliance to US laws by all manufacturers within US.

The concept of‚ Fabless‚ semiconductor business was new, and its intentions were to enable the semiconductor companies to focus on complicated circuit designs and outsource the manufacturing of wafers to external foundries. The biggest cost involved in manufacturing semiconductors is state-of-the-art tools and down time of manufacturing tools.‚ The seeds of fabless semiconductor eco-system were sown when it was realized that it was possible to minimize labor costs of manufacturing by outsourcing semiconductor manufacturing to Asian countries with lower value of currency‚ [5]. It was believed that this approach would give Fabless semiconductor companies extra revenue to invest in research and development of products.

Due to ¢‚¬ËœFree Trade¢‚¬„¢, it was very cost effective for the US fabless companies to carry out cheap manufacturing in LLCs and to then bring back the goods into US even without any import duty. Initially, Fabless semiconductor companies like Qualcomm, Broadcom, etc. were small businesses which could not afford high capital investments into semiconductor‚ Wafer‚ manufacturing. It costs more to establish and operate a state-of-the-art semiconductor wafer fab than how much it costs to set-up and operate a nuclear reactor. The ¢‚¬Å“Free Trade¢‚¬ and offshoring of manufacturing to wafer fabs in LLCs lead to very high profits for the fabless semiconductor companies, due to significantly lower manufacturing costs due to mass production from LLCs‚ [5]. This lead to extremely high year over year profits for fabless semiconductor companies and IDMs could not beat those profits because of higher labor costs in US as compared to LLCs.

Due to high returns on their investments, the value to shares for fabless companies soared to new highs. This offshoring manufacturing by Fabless companies and resulting profits elated the investors on Wall Street. It is Wall Street investors who pressurized the CEOs of IDMs to provide higher returns on investments for their outside shareholders. This is how Wall Street made small businesses like fabless corporations into huge corporations that sent all manufacturing jobs to LLCs in Asia. The Integrated Circuits (ICs) manufactured by fabless semiconductor companies also lowered the cost of consumer electronics imported back into US. It was believed that this business model would increase the affordability of consumer electronics and thereby increase consumer demand. Although this sounded like a great Micro-economic theory, in practice it was a grave Macro-economic blunder from the point of view of introduction of counterfeits into US Supply chain, trade deficits from Free Trade and Budget deficits from job losses at home.

Counterfeits Electronics due to Free Trade: a big National concern

Multi-National Corporations (MNCs) have been able to cut down manufacturing costs by outsourcing‚ their manufacturing to Asia, it was also observed that by bringing back the cheaply manufactured goods back into U.S. without any import duty would result in higher corporate profits. It was out of this logic that the concept of ¢‚¬Å“Free Trade¢‚¬ was born‚ [5]. This ¢‚¬Å“Free Trade¢‚¬ had no devasting effects on US Supply chain as long as US was home to manufacturing of semiconductor goods.

Defense Advanced Research Projects Agency‚ (DARPA) began as the‚ Advanced Research Projects Agency‚ (ARPA) created in 1958 by president‚ Dwight D. Eisenhower‚ for the purpose of forming and executing research and development projects to expand the frontiers of technology and science and to be able to reach far beyond immediate military requirements‚ [13]. A 2006 study from the Government Accountability Office (GAO) summarized the offshoring trend in semiconductor industry as follows: “The US semiconductor industry began offshoring labor-intensive manufacturing operations in the 1960s, followed in the 1970s and 1980s by increased offshoring of complex operations, including wafer fabrication and some research and development (R&D) and design work‚ [8].Scientists at DARPA made recommendations and US manufactured all defense-related products at home. However, consumer electronics were being built in LLCs due to low cost of labor. When technology progressed to AdvancedCMOS‚ transistor technology it became critical to have proximity of ¢‚¬Ëœlabs¢‚¬„¢ with ¢‚¬Ëœfabs¢‚¬„¢. Additionally, US military procured its ammunitions from independent private defense contractors who worked purely for profit. Due to much needed proximity of ¢‚¬Ëœlabs and fabs¢‚¬„¢, it required a large investment from defense contractors, who work for profit, to manufacture semiconductor wafers in United States and some independent defense contractors in China started supplying Chinese built ICs to US military‚ [5].

Counterfeit electronics have become a great concern for US semiconductor industry. Counterfeit ICs not only result in malfunctioning of modern electronics but also eat significant portions of profits from semiconductor companies and now have also become problem for Department of Defense (DoD) and have become a National security threat to the US. While US corporations try to enhance their profits by outsourcing manufacturing jobs to low wage countries like China, Chinese suppliers try to enhance their profits by introducing few counterfeit chips into US supply chain‚ [5]. Chinese labor may be cheap but it is prone to espionage, defects, counterfeiting and sub-standard material‚ [5].

If U.S. were to adopt ¢‚¬Å“fair trade¢‚¬ instead of ¢‚¬Å“free trade¢‚¬, it would have to impose tariffs on cheap electronics goods from China dumped into U.S. As consumers prefer to get best value for their money, U.S. consumers would prefer to buy ¢‚¬ËœMade in U.S.A.¢‚¬„¢ goods as tariffs would make them competitive with cheaper Chinese goods‚ [4]. This way not only would U.S. manufacturing jobs be preserved but also consumers would be reluctant to buy Chinese goods, if there are incidences of counterfeiting by Chinese suppliers‚ [4].

In order to sustain the Fabless semiconductor ecosystem based on ¢‚¬Å“Free Trade¢‚¬, high paying manufacturing jobs have moved offshore and this business model has resulted in increased dependence of foreign manufacturing which has also threatened the Intellectual Property (IP) of US corporations offshoring manufacturing technology to LLCs.

Trade Deficits due to Free Trade: Diminished Exports and Increased Imports

A 2006 GAO study showed that Semiconductor Assembly and Testing was the first to move to Asia, followed by fabrication and, more recently, by some design operations”‚ [8]. The GAO found out that the “US semiconductor industry has foreign operations in several locations, notably in Taiwan and China‚ [8]“. The higher corporate profits of Fabless semiconductor companies as a result of outsourcing offshore have transferred high paying manufacturing jobs from the US to LLCs like Taiwan and China. This has also resulted in loss of high paying manufacturing jobs from US, in order to sustain higher corporate profits. This has diminished the purchasing power of US consumers as they have to find alternative jobs in much lower paying service industry. Additionally, as purchasing power of US consumers has reduced, majority of consumers depend on cheaply manufactured goods coming into US from LLCs. Also, As US is no longer a home to manufacturing high tech products, the exports from US have reduced considerably.

This deceptively defective economic policy, in the guise of Free Trade, has resulted in a backlash and the once-upon-a-time US manufacturing innovation and economic dominance has been transferred to China. In this way, Globalization has worked to the detriment of American workers and reinforced unfair labor competition, because of lower wages and inadequate working conditions existing in LLCs which are often less developed countries‚ [16].

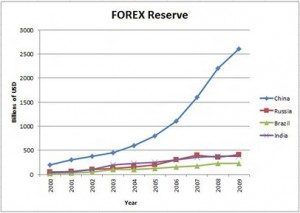

While the Trade deficit with China has resulted in soaring corporate profits for American MNCs that outsource manufacturing jobs to China, these policies have resulted in depreciating FOREX reserves for US. As a result of growing FOREX reserves, China has become a grave threat to US economy, as it is able to control the value of US currency. This now seriously threatens not only the global economic status and economic independence of the US, but also its R&D and now even its defense security. Figure 1 shows the FOREX reserves of BRIC (Brazil, Russia, India and China) in USD over ten years. According to Dr. Richard Haas, Chairman of the Council of Foreign Relations, China¢‚¬„¢s ownership of trillions in FOREX reserves is a great threat to the United States, as China (with its vast FOREX reserves), is in a position to influence US foreign policies‚ [4]. The current annual US trade deficit is close to 600 billion‚ [4].

Figure 1: World FOREX reserves in Billions of USD as per International Monetary Fund (IMF), April 2009‚ [4]. As shown in figure above it is clear than over last decade China has accumulated over 2 Trillion USD in FOREX and Russia has accumulated close to 500 million USD in FOREX. With such huge FOREX reserves, China can influence US foreign Policy by threatening to collapse US economy by dumping its reserves, in case US opposed any political ambitions of China in coming years. This is how “Free Trade” has been a deceptively defective policy.

Budget Deficits due to ¢‚¬Å“Free Trade¢‚¬: Increased Unemployment and Decreased Consumer Purchasing Capacity ‚

As a result of ¢‚¬Å“Free Trade¢‚¬ policies when high paying manufacturing jobs have been offshored to LLCs, US workforce has to take over the relatively low paying service jobs. The rising wage-productivity gap in US has decimated the consumer purchasing capacity‚ [4]. Lower consumer demand leads to lower tax revenue from the consumers. Due to lower taxes the government earns lower revenue which leads to budget deficits as a result of government.‚ This is the main reason why the budget deficit rocketed after 2007, so much so that it almost tripled from about $500 billion in 2007 to $1.3 trillion in 2011 spending in economy or government tax cuts for the wealthy to boost consumer demand‚ [4]. Thus, the real job creators in a free market economy are not only the producers of goods but also the consumers of goods. Every company estimates its consumer base prior to manufacturing in order to avoid the over-production of goods‚ [4].

The lower pay from low paying service jobs has also forced US workers to become consumer of cheaply manufactured goods from LLCs. This has made US economy dependent on external manufacturing. Also, the rising budget deficit has been primarily helping the manufacturers in US who offshore jobs to LLCs. For instance, in 2011 the economy generated 1 million new jobs with the help of a budget deficit of $1.3 trillion. If you divide 1.3 trillion with 1 million, you get 1.3 million. In other words, the government spent an extra $1.3 million to create one job in the economy. Is this not absurd, given the fact that the average wage is only $50,000 per year? Thus, the government deficit is now mainly helping the manufacturers, who must be getting the difference between $1.3 million and $50,000 for each person they hire‚ [4]. This is pure crony Capitalism at work where only a few prosper resulting in huge wage disparities as shown in figure 2 below.

![Figure 1: Annual U.S. income share of the Top 1% 1910-2010. As shown in the figure above huge disparity in income caused great depression during 1930s and the same disparity is also the cause of great recession that has started since 2007 [11].](https://apekmulay.com/wp-content/uploads/2013/05/Untitled-3-300x235.jpg)

Figure 1: Annual U.S. income share of the Top 1% 1910-2010. As shown in the figure above huge disparity in income caused great depression during 1930s and the same disparity is also the cause of great recession that has started since 2007 [11].

The last time such high disparities came in place, it resulted in great depression of 1930s. Now, US economy in particular and global economy in general has been in great recession since 2007. Both these facts point to the fact that recessions and depressions are caused because of huge wealth disparities. Another interesting fact to note from above graph is the rise in incomes of top 1% started in 1980s after election of Ronald Reagan as president of US and the tax cuts that were enacted for top 1% which the republican politicians proudly call ¢‚¬ËœReaganomics¢‚¬„¢ which was in fact a huge economic malpractice that was enacted to encourage profiteering of the wealthy resulting in protests on Wall Street in the name of ¢‚¬Å“Occupy Wall Street¢‚¬ movement by exploited masses with slogans ¢‚¬Å“We are the 99%¢‚¬.

The Myth about ¢‚¬ËœFree Trade¢‚¬„¢:‚ Depreciating US FOREX reserves and channeling entry of Counterfeit Electronics goods into US — Time for Reform!

As we have pointed out in the previous three sub-sections, ¢‚¬ËœFree Trade¢‚¬„¢ has been behind loss of high paying manufacturing jobs from US to LLCs resulting in not just huge budget deficits through high wage disparities causing a backlash against 1% wealthiest Americans but it has also been the cause of irrecoverable Trade deficits resulting in depreciating US FOREX reserves and channeling entry of counterfeit and sub-standard electronics and semiconductor goods into US supply chain.

The free trade policies of the United States are creating a perfect storm for its Electronics and semiconductor industry. According to Professor Ravi Batra, ¢‚¬Å“Free trade has done to the United States what Hitler and Imperial Japan could not do during the war.¢‚¬ He characterizes free trade as the ¢‚¬ËœAgrification syndrome¢‚¬„¢ by which Americans continue to lose manufacturing jobs, and continue to work harder at the jobs they do have, but suffer declining wages, despite increases to their productivity‚ [4].

Hence, now it has become increasingly urgent to develop appropriate Macro-economic reforms, so as to reform US Trade policies to ¢‚¬Ëœbackshore and in-source¢‚¬„¢ the US manufacturing jobs lost due to outsourcing offshore. Such reforms should be intended towards eliminating trade deficits through ¢‚¬Å“Fair Trade¢‚¬ policies instead of ¢‚¬Å“Free Trade¢‚¬ policies. The rejuvenation of hi-tech manufacturing in US would also create high paying jobs eliminating the budget deficits and retiring National debt. For this purpose, better incentives have to be made to bring back manufacturing to US rural areas and making it internationally competitive, in relation to the Low Labor Cost (LLC) countries, through incentives of capital grants, lower corporate tax rates, tax holidays, etc. In order to enable this process, it is also necessary to establish more rural universities so as to technologically support the ¢‚¬Ëœbackshoring and in-sourcing¢‚¬„¢ of the Electronics and Semiconductor manufacturing industry.‚ A good R&D collaboration between the rural universities and industries would reduce the R&D costs for companies by getting R&D done from local universities resulting in win-win situation for both the companies and the universities‚ [16].

Along with all the proposed reforms it is very essential to reform the industrial management structure for companies so that economic blunders in past never happen in future. We propose a co-operative organizational and managerial structure for companies. In this arrangement, the employees will share management decisions and profits. This incentive of employee-profit sharing would help rejuvenate the US electronics and semiconductor industry restore prosperity for all Americans, by enhancing their purchasing capacity for household and technological products. This in turn will help to preserve the incentive for hard work and the realization of the‚ Once Upon A Time American Dream.

Proposed Economic Reforms towards engendering long term US economic growth by means of favorable Tax policies, and effecting Rural University-Industry collaboration‚

Tax Reforms, to provide incentives to MNCs that LLCs provide:

Beneficial corporate policies are needed to bolster competition between US electronics and semiconductor manufacturing corporations. The federal and state governments need to deeply consider providing incentives for setting up manufacturing industries in rural areas. The advantage of setting up manufacturing in rural areas is the lower cost-of-living and lower pay scales in rural areas, as compared with big cities. It costs manufacturers roughly $1 billion more to build wafer fabrication facility in the United States ($6.7 – $6.8 billion) than in foreign LLC locations ($5.6-$6.1 billion). Labor cost for semiconductor manufacturers, accounts for only 20% of cost differential in Semiconductor manufacturing from rural areas‚ [16].

Hence, labor costs advantages enjoyed by LLCs would become less advantageous for MNCs to continue to have their semiconductor manufacturing plants abroad, if the federal and state governments were to provide them with incentives, which are provided by LLCs, to bring back their manufacturing plants to home rural regions. To further force the MNCs to ¢‚¬Ëœbackshore and in-source¢‚¬„¢ their manufacturing operations, in ‚ addition to eliminating all loopholes in the import duty and tax structure, the MNCs should also be forced to pay same tax rate as would be required for domestic industries . Incentives in terms of generous tax holidays, providing broadband services, good roads and public transportation services, exemptions on sales taxes, accelerated depreciation of industrial tools and expedited processing of industrial projects (as provided by LLCs) would all serve to make MNCs make investments in setting up their manufacturing plants ‚ in rural areas‚ [1][14].

Domestic Higher Educational Institutions, to support home return of the Manufacturing Industry:

Now we have talked about bringing back home the MNCs manufacturing operations to our Rural towns and counties.‚ For this purpose, we need to set up more rural educational institutions.‚ The American rural economy has been down for a long time. Hence it is now important for the Rural towns and counties to take upon themselves the responsibility for funding the setting up of rural colleges and universities by budgeting for them.‚ In turn, the rural towns and counties would get returns in the form of getting their infrastructural projects carried out at these colleges and universities at lesser costs.‚ These infrastructural projects consist of building and maintaining roads, water-supply, sanitation, renewable energy systems expansion of broadband infrastructure, etc‚ [6].

On top of the return of investment made by rural townships to set up rural and home-grown colleges and universities in the form of cheaper and even more elaborate infrastructural projects, the rural colleges and universities would be able to provide the technological and R&D support to the manufacturing companies, to make it attractive for them to relocate their manufacturing plants to rural regions.‚ The relocation of manufacturing plants in the rural regions would enhance jobs and employment in rural regions. So, as we see, some forward thinking and planning needs to be carried out by the economic and industrial development boards of the rural regions.‚ Setting up rural colleges and universities would enhance home-based higher education, rural infrastructure, rural population, rural employment and consumer demand; all of this would enhance rural economy and hence the national economy‚ [15].

These Home-grown Higher Educational Institutions (HG-HEIs) can stimulate local industrial growth, attract urban companies to shift their manufacturing operations to cheaper cost-of-living rural regions, and also provide incentives for MNCs to return home. Hence, a combination of tax incentives and HG-HEIs can result in re-developing Rural (and hence national) economy, and make up for the cost incurred by the local counties to set up ¢‚¬Ëœhome-grown educational institutions¢‚¬„¢. Investing in rural economy would help rejuvenate the regional as well as the national economy. This is an innovative scheme proposed by author Professor Ghista in his drive and innovative planning of Ozark Rural University‚ [6]‚ as a nation-wide model and trigger for‚ Rural development through Rural Universities.

University-Industry Consortium, for Low Cost Manufacturing R & D:

Now we are proposing that the rural universities and the manufacturing companies can organize collaborative R&D operations, which would reduce R&D costs and simultaneously subsidize R&D at universities.

Let us go one step further and propose setting up University-Industry Consortium. This consortium will sponsor R&D that can result in development of new technologies by the doctoral students.‚ With these new technologies, the Consortium can encourage entrepreneurship by incubating new companies.

Hence, a co-operative partnership called the‚ ¢‚¬ËœUniversity-Industry Consortium¢‚¬„¢‚ should be established between rural universities and companies, in order to sponsor research of doctoral students¢‚¬„¢. The technologies resulting from this R&D should be jointly owned by this ¢‚¬Ëœconglomerate¢‚¬„¢ and by the doctoral students and their supervisors. The doctoral entrepreneurs can employ the master¢‚¬„¢s degree graduates in their companies with an incentive of employee profit sharing. This will be a win-win situation for both the universities as well as the companies: the universities can get their R&D sponsored by the companies, which in-turn can get their R&D carried out within the universities more efficiently and at much lower cost‚ [16].

Industrial Structural Framework and Managerial Reform towards a neo Co-operative Economic model of Companies: Towards Company Economic Assets Shared by its Employees ‚

The investors on Wall Street have all along demanded very high returns on their investments and Wall Street, thereby pressurizing US businesses to outsource high paying manufacturing jobs offshore, in order to increase corporate profits and higher stock value to feed on the financial appetite of greedy investors. To end this blood-sucking of businesses and corporations by Wall Street investors and stock holders, we are proposing a radical change in the company¢‚¬„¢s internal organization and management framework, by stipulating that only the company employees should be permitted to become the majority share holders (with only banks involved in sponsoring companies) and not the wealthy Wall Street outsider stock holders in US companies. The company employees would also then automatically become involved in sharing managerial decisions and company profits. In other words, the company would then be organized as a co-operative, wherein all the staff are partners and have say and stake in the company operation and policy.

This neo company organizational structure will enable the companies to become independent and freed from outside colonized ownership and policy making. This will herald what can be termed as‚ Industrial Independence from Wall Street Colonization.‚ ‚ The CEOs and CFOs of companies would then be free to make collective managerial decisions jointly with and in the best interests of their employees and in fact of the companies also. ‚ This neo company structural framework of employee empowerment would enable employee partnership in ownership and participatory decision making, leading to personal fulfillment for the employees. Since, their‚ hard work‚ would bring them higher income returns, such a business model driven by the motivated company-stock owner employees would increase incentive to work hard and reap rewards for hard work‚ [2]. Thereby, the hard working employees would be rewarded with higher incomes through profit sharing. With the higher incomes, they would become more ready to make purchases. Thus, consumer spending and demand would increase, and thereby revitalize industry and economy.

Concept of Co-operative Ownership of Companies, based on Mass Capitalism:

This system of Cooperative ownership of companies, resulting in “Mass ownership and cooperative management” by employees, constitutes an economic system that is based on Mass Capitalism‚ [2] [10]. In fact, we may need to redefine the term of ¢‚¬Ëœcompany employee¢‚¬„¢ to a new and more respectable term signifying participatory management and decision-making, such as‚ co-op staff. These employee guided firms will then naturally also be able provide health insurance and pension benefits to workers, and the government would not need to spend money for this purpose which results in budget deficits‚ [10].

This system would eliminate “outside (Wall Street) shareholders” and make the companies insulated from their pressures to increase profits at the cost of the employees¢‚¬„¢ interests and the national interests.‚ Elimination of outside interference by institution of this Cooperative Business Managerial System (CBMS) will help to preserve incentive to growth and not only avoid undue pressure from investors on Wall Street to ship jobs overseas but would also eventually put an end to even the presence of Wall Street and restore the country back to its 99% population, who have started the ¢‚¬ËœOccupy Wall Street¢‚¬„¢ movement to protest against crony Capitalism and Wall Street¢‚¬„¢s greed. In fact who needs Wall Street, if we can eliminate its financial speculation, malpractices and economic bubbles through economic self-regulation with minimal government interference‚ [4].

This policy of cooperative ownership of companies policy would also ensure that wages of hard working Americans catch up with their productivity, ‚ eliminating budget deficits, and pave the‚ way for balanced economy, thereby constituting both micro and macro economic reforms .‚ This CMBS is most innovative way to rejuvenate US electronic and semiconductor business and it would also restore the Legitimacy of US supply chain.

Towards Mass Capitalism and Realization of the All American Dream:

Finally, let us announce one overarching benefit of CMBS.‚ Thus far, CEOs and owners of corporations have dominated the 99% American working class, by controlling businesses, banks and even governance policies. Now when, due to this CMBS, the 99% workers of companies and businesses have joint stake in the company and business operation and policy making, the economy will automatically come within the control of the 99% Americans[11][16].

This will in fact replace Corporate Capitalism by Co-operative free market Capitalism, and bring relief to the 99% Americans. With that, many policies will become 99% people-centered‚ [11].‚ For instance, we could even make theuniversal healthcare‚ dream‚ of the 99% people become a reality.‚ Not just that, but we can foresee the realization of the‚ All American Dream of Education for all, Healthcare for all, Housing for all, Jobs for all, and Fulfilling Lives for all!‚ [15]

References

[1] “The Offshore Outsourcing of Information Technology Jobs in New York State ¢‚¬œ A report to David A. Paterson, Governor and the legislature of the state of New York”, New York State Department of Labor and Empire State Development (September 2010).

[2] P.R. Sarkar ,”PROUT in a Nutshell”, AMPS (1959).

[3]World Trade Organization from Wikipedia, the free encyclopediahttp://en.wikipedia.org/wiki/World_Trade_Organization.

[4] A Mulay, A Failure Analysis of the US Economy, Truthout.org (2 March 2013).‚ http://www.truth-out.org/news/item/14887-a-failure-analysis-of-the-us-economy

[5]Apek Mulay, “Mitigation of Counterfeit Electronics through Macro-economic Policies¢‚¬, Pgs. 45-47 Electronic Device Failure Analysis Magazine, Volume 15, Issue 2. (May 2013)

[6] Dhanjoo N. Ghista, Ozark Rural University, West Plains Daily, Howell County, Mo (19 March 2012).

[7] Dale W. Jorgenson, “Moore¢‚¬Ëœs Law and the Emergence of the New Economy”, Semiconductor Industry Association, 2005 Annual Report (2005).

[8] “US Semiconductor and Software Industries increasingly produce in China and India”, Government Accountability Office (September 2006).

[9] Jon D. Samuels, “Semiconductors and US economic growth”, Department of Economics John Hopkins University and IQSS Harvard University (1 April 2012).

[10] P R Sarkar, ¢‚¬Å“Proutist Economics: Discourses on Economic Liberation¢‚¬, AMPS (1992).

[11] Dhanjoo Ghista, ¢‚¬Å“Socio-Economic Democracy and the World Government: Collective Capitalism, Depovertization, Human Rights, Template for Sustainable Peace.¢‚¬ World Scientific Publishers (2004).

[12] Saez, Emmanuel, ¢‚¬Å“Striking it Richer: The Evolution of Top Incomes in the United States¢‚¬ (January 2013).http://elsa.berkeley.edu/~saez/saez-UStopincomes-2011.pdf

[13] DARPA from Wikipedia, the free encyclopedia‚ https://en.wikipedia.org/wiki/DARPA

[14] Dhanjoo Ghista and Apek Mulay, ¢‚¬Å“Distorted Supply Chain Caused by MNCs Manufacturing Abroad and How to Restore Its Legitimacy¢‚¬, Truthout.org (19 August 2013).

[15] Dhanjoo Ghista and Apek Mulay, ¢‚¬Å“Loss of US Dominance in Global Electronics and Semiconductor Industry: Causes, Solutions and Economic Growth¢‚¬, Truthout.org (13 June 2013).

[16] Apek Mulay and Dhanjoo Ghista, ¢‚¬Å“Globalization of Semiconductor Manufacturing Industry From Deception to Reformation Towards Recovering US Macro-Micro Economic Losses¢‚¬, Electronics.ca Research Network (24 June 2013). ‚ http://www.electronics.ca/presscenter/articles/2071/1/Globalization-of-Semiconductor-Manufacturing-Industry-From-Deception-to-Reformation-Towards-Recovering-US-Macro-Micro-Economic-Losses/Page1.html

Recent Comments