The end of financial Capitalism is very near. Please watch below video to understand the serious trouble with Deutsche Bank. Well, German Chancellor Angela Merkel gets the blame but does anybody question the intelligence of ECB chair? What was the logic behind the negative interest rates? How insane was the move to enter into negative interest rates just to protect the interest of a wealthy few and completely ignore the purchasing power of majority in the economy?

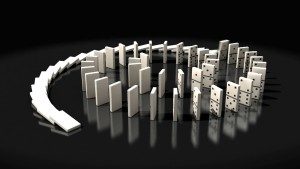

Just like Lehman Brothers collapse triggered the domino effect on the entire financial system, Deutsche Bank collapse will cause a collapse of the global financial system. Well, We all will be looking forward to what happens after the bank holiday on Monday (1 May 2017). Well, Most likely over the weekend, the ECB officials will try to arrange for a bailout for Deutsche Bank. Another band-aid …and again the losers would be the German tax payers. Well, Are we not sick and tired of this endless cycle of bailouts?

The root cause of all problems lies in today’s Crony Capitalism with the suppression of wage growth in an economy and extracting maximum productivity from employees at lowest wages. Well, What is happening due to such policies is that there is overproduction happening all across the world because productivity of employees is so high but their purchasing capacity is so low. Hence, the government has to support creation of more and more debt to ensure consumption of overproduced goods and this still keep the wages of employees low. The entire system has become so corrupt that even many business schools do not teach common sense economics of supply and demand to their graduates because if correct knowledge was provided in first place, things would not have become so bad. The politicians are already sold out to their wealthy donors.

It is high time that moral corruption in the profession of economics is brought to an end else there is no way out of it. We saw the rise of Trump in US, Le Pen in France, Modi in India, etc. and that is due to rage of the people against the growth in taxes, lack of good jobs and no control of the politicians over government spending. Well, All this does feel like a silver lining on cloud but the fact is that just cutting government spending is not going to solve the problem. There has to be growth in wages in an economy. That growth has to be tied to growing productivity of workforce.

I have been writing about the faulty monetary policies of central banks and my first volume MASS CAPITALISM: A BLUEPRINT FOR ECONOMIC REVIVAL, precisely deals with these faulty policies of the US Central bank (the Fed) and its impact on tech industry. Well, When the central bankers are elected by the heads of the respective economies, I wonder why is that the heads of different countries do not elect a central bank chair who understands that what is happening is absolutely immoral and there has to be a 180 degree shift in their direction. This applies to all economies because even after bashing Fed chair Janet Yellen during his election campaign, President Trump wants to keep Fed’s interest rates low to support his infrastructure and defense spending, Modi in India has already lowered the repo rate of RBI by up to 1.75 to 2.00 basis points but it is not showing any significant growth in the economy. But, Even a country like India which used to be a conservative nation of savers has become a nation of debtors.

What Modi’s team does not understand that if India goes on the path of the U.S., the money that would be needed to bailout the banks in India will lower the value of INR and further increase the poverty in the country. I mentioned about the dangers of Negative Interest rates, just on the day the rates went into effect in Europe. You can read my article published on 5th June 2014 – ‘Negative interest rates of central banks could burst debt bubble like a fire cracker?‘

Well, If you have read Elisabeth kübler-ross’s five stages of grief, I believe that ECB should be actually be Stage 4. Well, the sooner ECB and other global central banks move to stage 5, the better for the global financial system. People are sick and tired of this economy which is stagnating for too long and there is no hope for any growth. The global unemployment is very high and besides the housing loan bubble, many more bubbles have grown excessive in last 8 years due to bogus monetary policies followed by global central banks which lures people into larger and larger debt. These bubbles include the auto loan bubble, student loan bubble, etc. Hence, When one bubble burst, it would result into a domino effect and bursting all bubbles in global economy. Yes, Global Capitalism is going to burst like to FIRE CRACKER. There is a time bomb and when it is going to explode is very unpredictable.

As explained above the root cause of the crisis is the growing gap between wages and productivity in global economy. Hence, The ONLY way for the global economy to come out of the impending economic depression is to reform their policies to restore free markets so that wages keep pace with productivity automatically. The more the delay in adopting these common sense policies, the more will be the intensity with which the crisis strikes the respective economies.

About the Author

Apek Mulay is a Business and Technology Consultant at Mulay’s Consultancy Services. He has authored a trilogy in three consecutive years viz. Mass Capitalism: A Blueprint for Economic Revival (2014), Sustaining Moore’s Law: Uncertainty Leading to a Certainty of IoT Revolution (2015) and How the Information Revolution remade Business, and the Economy: A Roadmap for Progress of the Semiconductor Industry with More than Moore and Beyond Moore (2016). His monograph on technology is entitled Improving Reliability of Tungsten Plug Via on an Integrated Circuitry: Process Flow in BiCMOS and CMOS technology with Failure Analysis, Design of Experiments, Statistical Analysis & Wafer Maps (2016). Mulay is author of patent Surface Imaging with Materials Identified by Colors. USCIS honored him with US permanent residency under the category of foreign nationals with extraordinary abilities in science and technologies. He engineer, economist, author, blogger and social entrepreneur in an e-commerce business http://Calcuttahandicraft.in .www.ApekMulay.com

Mass Capitalism is also available as Audio book on Audible. It is being translated into local Indian language to be released in India as well as Mandarin language to be released in China.

Recent Comments