Annuities

Annuity is a contract with the Insurance Company that gives a specific amount of income in retirement. Annuities are offered by Life Insurance companies but work exactly opposite of the Life Insurance companies. In common terms, Annuity is an insurance policy that wraps around the invested money to protect that money. Annuity has two stages viz. Accumulation stage and Annuitization stage or payout period. Annuities act like supplement retirement agents. Investing in an Annuity is equivalent to investing in a CD except that the Interests earned with CD is taxable and interest earned with Annuity is tax deferred. Since Annuity is a contract with Insurance Company, in order to avoid short term investments with insurance company, there is a surrender charge imposed by insurance company for early withdrawal. In addition to surrender charge, the Internal Revenue Service (IRS) also levies a 10% penalty if money is withdrawn before the age of 59 ‚½ years. The 10% penalty is waived for disability and death. Although Annuity have a death benefit they do not work like Life Insurance which means that the beneficiary would have to pay taxes on the death benefit amount as ordinary income tax ( but not as capital gains tax ).

Annuities are of three types viz. Fixed Annuity, Indexed Annuity and Variable Annuity.

Fixed Annuity ¢‚¬œ They have a principal guaranteed and interest rate guaranteed. They were offered in 1970s and 1980s. The money grows higher than CD or money market.

Indexed Annuity- These have principal amount that is partially of wholly guaranteed by insurance company. The minimum rate of interest may be guaranteed but growth depends on market index of S&P 500. The rate of return is higher than fixed annuities and they are no averse to risk.

Variable Annuity- These annuities guarantee minimum interest and have much higher rate of return.‚ Most importantly these annuities guarantee an income stream but have a fee associated with them.

An annuity has no probate or life insurance payout while a 401k plan goes into probate. This means that the money in 401k plan is automatically received by beneficiary after 5 years death anniversary of primary contributor unless a will or trust is made.

The following are the payout options with annuities-

- Pure or straight (Fixed money received until death) – These have highest risk as upon death of the policy holder, the beneficiary does not get anything and insurance company keeps everything. However, the payout is maximum with this option.

- Life of Policy with a defined period ¢‚¬œ This option allows a guaranteed pay for a few years. It is less risky and remainder amount goes to the beneficiary upon death.

- Refund life ¢‚¬œ This payout option gives least money but it acts as an income over the rest of span of life. It is the safest option.

- Joint and Survivor payout option ¢‚¬œ This option lets both spouses receive a payout as it is a joint account.

- Fixed period payout ¢‚¬œ The payout is for a fixed number of years and in case of death of policy holder, the beneficiary gets the remainder amount.

- Fixed amount payout ¢‚¬œ The payout is fixed in its amount and lasts as long as the money in annuity account exhausts.

Advantages of Annuity

- Money grows tax deferred and provides income until death without Annuitization or through optional living benefit.

- Provides a death benefit to the beneficiary.

- Treated very similar to IRA (Individual Retirement Account) and contributions work for tax purposes.

Q. What to do with money in your 401k account in case of a layoff from employer?

A. There are five options with that money

Option 1- Leave money as it is and pay fees to the financial institution who has to manage that old 401k account.

Option 2 ¢‚¬œ Rollover the money to new employer¢‚¬„¢s 401k account. But, the new employer may not have a good match for the money put into the account.

Option 3 ¢‚¬œ Convert the 401k account to Roth IRA account to have flexibility of investments but that would need paying taxes to IRS for conversion of the account.

Option 4 ¢‚¬œ Move the money to fixed or indexed annuity where the money grows with the stock market. In case of fixed annuity, there are no fees and there is guaranteed principal amount. In case the financial firm which holds the fixed annuity account fails, then the principal amount is guaranteed by state guarantee fund.

Option 5 ¢‚¬œ Move the money to a variable annuity where the money grows at much higher interest rate than fixed annuity with the rise in stock market. The risk of money reducing in its value can be minimized by adding a rider protection benefit. This would have additional fee up to 1% but it would provide insurance on the principal amount plus growth.

Tax Planning

‚ As a Macro- economist and a financial Analyst, I would advise you on your tax planning.‚ While I believe in very low to no income taxes on individuals as mentioned, I believe that with today¢‚¬„¢s existing tax structure, one could live a better life with good tax planning. Tax planning is not tax evasion neither it is going against the rule of law. But, Tax planning helps individuals to make use of certain financial products which would help take advantages of the current tax system and plan for a better and secure retirement when the amount of taxes you owe is low.

What is Tax Planning?

Taxation by IRS is probably the most challenging situation facing your life. When you earn money, you owe taxes to IRS in form of Income tax or business tax. When you spend your hard earned money, you pay taxes as sales tax. When you save money, you owe tax to IRS in from of investment tax on you short or long term capital gains. Even when you die, you owe a tax in form of Estate tax. We can observe that taxes are the largest single expense of our life. Tax planning is how to legally get back more control over your money including how much and when you pay your taxes. Tax planning does not help you to earn much but helps plan on how much of your earned income you can keep. Tax planning is part of financial planning which is also a part of life planning.

Why we need Tax Planning?

- To understand taxes and their consequences

- To make informed decisions in personal life as well as in business operation

- To design a right financial strategy

- To control and protect what you have in form of Assets

- To reduce the risk of penalties and audit

What Strategies can you use to maximize you tax returns?

- Lower your Annual Gross Income to qualify for lower tax bracket when possible

- Balance the itemized deduction vs. standard deduction

- Try to qualify and get all tax credits (retirement, education and child credits etc.)

- Own retirement accounts or any tax deferred investment plans (e.g. IRAs & annuities) may help you get more tax money back

- Own a business to gain more tax deductions and benefit (schedule C and solo 401K, etc.)

Tax planning for Businesses

According to section 162(a) of Internal Revenue Code, ¢‚¬Å“There shall be allowed as a deduction, all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.¢‚¬‚ The difference between being an employee and owing a business is that an employee earns money, pays taxes on his/her income and then gets the remaining amount to spend. In case of a business owner, s/he earns money and spends money and then pays taxes on remaining amount. As a business owner, one can design how much one wants to earn and spend. A business owner can also time the receipt of income and hence can also time the payment of taxes on that income. As a business owner, one can write off the expenses which come under qualified business expenses. Following are the examples of business expenses which a business owner can write off on form Schedule C which s/he files with income taxes.

- Office/Professional Expenses – plug in fees, license fees, exam fees, pre-licensing fees; continue educations, E&O etc.

- Supplies – printers, computers, folders, computer bags, pens, pads, books, postages etc.

- Advertising – Sales kits, Christmas parties for clients, greeting cards, gifts for clients etc.

- Travel Expenses ¢‚¬œ registration fees for conventions, air tickets, cab ride, meals, gas, car rental etc.

- Meals and Entertainments – (50% deduction) business lunch, business dinner with prospects, clients, partners, house parties for team, etc.

- Utilities – cell phone bills, internet/cable bills

- Vehicle Mileage Deductions – (50.5 ¢‚¬œ 58.5 cents per mile), or actual car expense

- Other expenses – Laundry, business clothing, business publications

The pros and cons of 401K Retirement plans

Today, most employers offer 401k plans to their employees as part of retirement services. Some employers also match employee contributions up to a certain amount in order to encourage the employees to contribute a portion of their salary towards retirement.

The following are the advantages of 401 K plans

- Pre-tax dollar contribution and hence it helps save some money on taxes

- Some companies offer a few percentage match on your total contribution

- Helps lower your AGI in your income tax return

- The money get invested systematically using dollar cost averaging

The following are the disadvantages of 401 K plans

- Pre 59 ‚½ usage penalty by IRS (10%)

- Minimum distribution requirement is at age 70 ‚½. If not, there is 50% penalty.

- Loan payback using after tax money

- 401k plans offer a limited investment choices

- There are no personal advisory services

- The money grows with the stock market growth but the principal amount cannot be guaranteed and the account could well loose its value with fall in stock market.

How does one plan for a secure retirement?

In current tax system and tax laws which are made by the Internal Revenue Service (IRS), individuals pay taxes on their income. These taxes are supposed to go towards running the government and to set up infra-structure for public use. ‚ Social security is going to bankruptcy because of official monetary policies by Alan Greenspan who was the advisor to President Ronald Reagan. During his presidency, Reagan enacted tax cuts for wealthy Americans which resulted into chronic Budget Deficits.

As an advisor to the president Reagan, Alan Greenspan, raided the social security trust fund to pay for the budget deficits generated from the tax cuts given to the wealthy. It is no doubt that Fed chairman Alan Greenspan, who also received Knighthood from Queen Elizabeth of UK, committed a massive fraud during his 20 years tenure as Fed chairman by bankrupting US Social security system. This fraud was exposed by Professor Ravi Batra from Southern Methodist University (SMU), Dallas, TX in his book ¢‚¬Å“Greenspan¢‚¬„¢s Fraud¢‚¬.

It is because of Greenspan¢‚¬„¢s fraud that today middle class America has lost their social security savings which were meant to take care of their retirement. Fed monetary policies during Greenspan¢‚¬„¢s tenure have resulted in a huge disparity in wages and today just 1% of Americans control more than 97% of the wealth in US. It should be noted that the era of 1950-60 was considered as the golden era of free market capitalism. During this decade the top 1% Americans paid a highest tax rate of 92%. Yes, the highest income tax rate during 1950s was 92% but in spite of higher taxes on the wealthy, the annual growth in GDP was over 4% per year during this decade.

This growth occurred because the most important engine of economic growth in any economy is high consumer purchasing power. When consumer purchasing power is high in economy, people are able to spend money and hence they can generate an economic demand. Once there is an economic demand, then the producers can produce goods to meet those demands. Why was the consumer purchasing power high during 1950s-60s? Since top 1% wealthy paid highest tax rate of 92%, the taxes which included the social security taxes and payroll taxes were low on remainder 99% of population.

Due to lower incomes taxes, the purchasing power of 99% was very high and so was their contribution to economy through higher economic demand. What happened since Ronald Reagan¢‚¬„¢s tax cuts is that taxes on top 1% fell from 92% to 28%. While the wealthiest faced a 28 % tax rate, those with lower incomes faced a 33% rate; in addition, the bottom rate climbed from 11 percent to 15 percent.‚ Because of this the social security taxes and payroll taxes had to be raised on remainder 99% to pay for the rising budget deficits. Because of FED Monetary policies since Greenspan, consumer purchasing power started to decrease and consumer debt started to increase to keep the economy going.

In order to offset for that the government started an official monetary policy to lure Americans into borrowing because they did not have sufficient consumer purchasing power to generate an economic demand. This is how consumer debt started to grow. The outsourcing of high paying manufacturing jobs to LLCs, US National debt started to grow due to joblessness of laid off workers and government spending towards unemployment benefits. This is how National debt has been steadily growing over the years and today it has reached 17+ trillion USD.

Based on the above analysis, I can conclude that the tax rates have to grow in coming years. It took 30+ years of Regan¢‚¬„¢s tax cuts for the National debt to reach 17+ Trillion dollars. This debt would not be repaid overnight and taxes have to go up in future!

What tax information you receive from the above analysis?

Since the taxes are low today and would grow tomorrow, if you plan to retire in future, you will have to pay high taxes on your tax deferred accounts. Which are the commonly used tax deferred retirement accounts? Majority of Americans contribute to their retirements in their 401 K plans for which they also get a match from their employer. In these plans, individuals do not pay taxes presently assuming that they not only get employer match but also that when they retire that tax rates would be lower. Based on the above analysis, I have proved that tax rates would be higher for next 30 years under current economic system to pay back US National debt and to restore a balanced economy. Hence, when you retire you should expect a huge tax bill on your tax deferred accounts like IRA (traditional), 401k, 403B, 457 and other pension plans, SEP & SIMPLE IRAs, Solo 401K, DB/DC plans Annuities, Saving Bonds, etc.

Internal Revenue Code 7702

There are three categories of Retirement services based on tax planning as mentioned below-

- Taxable (Tax Now) ¢‚¬œ saving, checking, CDs, mutual funds, stocks, bonds, treasuries.

- Tax Defer (Tax Later) ¢‚¬œ IRA (traditional), 401k, 403B, 457 and other pension plans, SEP & SIMPLE IRAs, Solo 401K, DB/DC plans Annuities, Saving Bond.

- Tax Free (Tax Never) ¢‚¬œ Roth IRAs, mini bonds, VUL/IUL/EIUL (IRC 7702) cash values, whole life cash values, 529 plan, education IRA.

In my previous analysis, I showed that taxes are going to go up in future. Hence, Tax planning I very important to minimize the tax burden in future.

This is why I recommend you to consider options to have your money invested where taxes would be lower in future irrespective of whether the taxes levied are going to be higher or lower for your income bracket. The retirement options which are based on tax free growth and tax free withdrawal would be immune to any changes to the existing tax laws.

In 2008, the US congress passed a new retirement solution under the Internal Revenue Code (IRC) 7702 for Life Insurance companies. Under this plan, contributions are made to this retirement plan, on your after-tax income but the gains are withdrawn with no income taxes.

Is this plan appearing to be similar to Roth IRA? No, there is a very important difference. ‚ In case of Roth IRA, individuals can take money out only after age of 59 ‚½ years. If there is any early withdrawal, they have to pay 10% early withdrawal penalty to IRS. Additionally, the maximum contribution per year for Roth IRA is only $5000 per year. However, with retirement plans under IRC 7702, the contribution amount is greater than $5000 and this contributed amount could be withdrawn with no penalty and with a small interest rate (less than 1%) any time after one year of opening this account. In addition to above mentioned benefits, IRC 7702 retirement vehicle insures the family of the individual up to $ 500,000 to $1 million as a death benefit.

All the growth in this retirement account is absolutely tax free. This program could be used for funding children¢‚¬„¢s education at much lower interest rate on loan from IRC 7702 (less than 1%) compared to high student loan rates currently offered by banks. All growth is tax free and hence when taxes are expected to grow up in near future, when you retire the 401k plan would pay high taxes but IRC 7702 will pay no taxes on withdrawal amount.

Following is a summary of the benefits of IRC 7702 plan:

¢‚¬¢ Unlimited contributions (premiums)

¢‚¬¢ Meaningful income tax-free death benefits, substantially more than any other alternative

¢‚¬¢ Tax-deferred growth of cash surrender values

¢‚¬¢ Tax-free retirement income*

¢‚¬¢ Tax-free loans at ANY age – There’s no 10% penalty tax for retiring before age 59‚½

¢‚¬¢ Policy death benefits and cash surrender values are assignable as collateral

¢‚¬¢ No tax penalty or tax liability when used to secure a loan.

¢‚¬¢ No required minimum distributions (RMDs) like an IRA or qualified plan, like a 401(k), 403(b), or 457 plans, so you can defer after age 70‚½.

¢‚¬¢ Tax-free income does not increase income tax liability on Social Security retirement benefits.

¢‚¬¢ Simple plan administration – No financial planning fees!

¢‚¬¢ No forms to file with the IRS by individuals (business owned policies are required to file forms)

¢‚¬¢ Potential asset protection from creditors and predators (varies by state, please consult with your legal counsel)

¢‚¬¢ Privacy – policy cash values are generally exempt from disclosure when applying for college financial aid

The only thing is that IRC 7702 plans have to be purchased only through a licensed agent and the agents are under the law of US government. It is very important that the certified financial agent looks into the best interest of client (considering their financial situation) rather than in the best interest of the advisor (to seek more commission). Hence, it is important for the advisor to have a contract will several providers of IRC 7702 rather than just one to choose the plan that best fits client¢‚¬„¢s individual financial needs.

Planning for College Financial Aid

When planning for college education of kids, it has to be remembered that scholarships are awarded on merit and financial aid is available on need.‚ The rising student loan debt across the country has reduced the economic contribution of students as students take years to repay their student loan debts. Additionally, Student loan debts cannot be wiped off by declaring bankruptcy. Hence, it is extremely critical for parents to plan for the education of their kids ‚ and help get maximum out of the federal financial aid offered to students. It is myth that all students cannot apply for federal financial aid (FAFSA) and it is very important for the parents to plan for their kid¢‚¬„¢s financial aid. While it is very important duty of any country¢‚¬„¢s democratically elected government to ensure that there is an equal access to quality education for all its students, when the government fails in doing its job, the responsibility falls on the shoulder of parents.

As discussed in previous section, the retirement vehicle IRC7702 could be used for planning for kids¢‚¬„¢ education. The table below gives details of need based financial aid for college students.

| ‚ | Federal Student Aid Program | Type of Aid | Program Details | 2013-14 maximum Award |

| 1. | Federal Pell Grant | Grant: Does not have to be repaid | Available almost exclusively to undergraduates; all eligible students will receive the Federal Pell Grant amounts they qualify for | $5,550 |

| 2. | Federal Supplemental Educational Opportunity Grant (FSEOG) | Grant: Does not have to be repaid | For undergraduates with exceptional financial need; priority is given to Federal Pell Grant recipients; funds depend on availability at school | $4000 |

| 3. | Federal Work Study | Money is earned while attending school; does not have to be repaid | For undergraduate and graduate students; jobs can be on campus or off campus; students are paid at least minimum wage | No annual maximum |

| 4. | Federal Perkins Loan | Loan: Must be repaid | Five percent interest loans for both undergraduate and graduate students; payment is owed to the school that made the loan | $4000 (under-graduate) $6000 (graduate) |

| 5. | Subsidized FFEL or Direct Stafford Loan | Loan: Must be repaid | Subsidized loan. US Dept. of education pays interest while borrower is in school and during grade and deferment periods | $2625 – $8500 depending on grades |

| 6. | Unsubsidized FFEL or Direct Stafford Loan | Loan: Must be repaid | Unsubsidized: Borrower is responsible for interest during life of the loan | $2625 – $18,500 depending on grades |

| 7. | Federal PLUS Loan | Loan: Must be repaid | Available to parents of dependent undergraduate students | Cost of Attendance minus any financial aid received |

‚

While filling up the FAFSA application form for student financial aid, the following is a list of assets that need to be disclosed and those assets which do not need to be disclosed. It is possible to gain more financial aid by moving money from assets which have to be disclosed to those that do not have to be disclosed. This is exactly how financial planning is to be done when funding for kid¢‚¬„¢s college education.

FAFSA application for Public Schools

| Disclosed Assets | Excluded Assets | |

| 1 | Real Estate | Cash Value of Life Insurance |

| 2 | Trust Funds | Retirement plans |

| 3 | UGMA (Uniform Gift to Minors Act) and UTMA (Uniform Transfer to Minors Act) accounts | Primary Residence |

| 4 | Money Market, Mutual funds, CDs, stocks, stock options, bonds, other securities | Business and/or investment farm value includes the market value of land, buildings, machinery, etc. |

| 5 | Coverdell savings account, 520 college savings plan, etc. |

FAFSA application for Private Schools

| Disclosed Assets | Excluded Assets | |

| 1 | Real Estate | Cash Value of Life Insurance |

| 2 | Trust Funds | Retirement plans |

| 3 | UGMA (Uniform Gift to Minors Act) and UTMA (Uniform Transfer to Minors Act) accounts | |

| 4 | Money Market, Mutual funds, CDs, stocks, stock options, bonds, other securities | |

| 5 | Coverdell savings account, 529 college savings plan, etc. | |

| 6 | Business and/or investment farm value includes the market value of land, buildings, machinery, etc. | |

| 7 | Equity of Primary Residence |

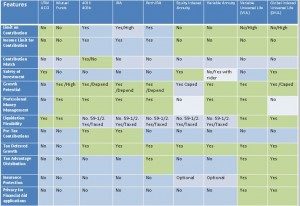

The Table below gives the different features of various college savings plans and compares them to other plans.

| Features | UGMA | Coverdell Savings Account | 529 college savings plan | GIUL/VUL Whole Life Insurance |

| Parental Control |

No |

Yes |

Yes |

Yes |

| Tax deferred growth |

No |

Yes |

Yes |

Yes |

| Tax free access |

No |

Yes |

Yes |

Yes |

| Investment Flexibility |

Yes |

Yes |

No |

Yes |

| Family protection |

No |

No |

No |

Yes |

| No penalty for withdrawal of money for any other usage |

Yes |

No |

No |

Yes |

| No impact of financial aid |

No |

No |

No |

Yes |

For any further information, please fill the‚ Financial Fact Finder Sheet 2014‚ and email me directly at engmulay@gmail.com with subject “Re: Free Financial Advise”‚ and I shall try to get a certified Financial Advisor from “Transamerica Financial Advisors” answer your questions promptly and help you achieve your personal financial strategy. This service is a complimentary service for visiting my blog. Keep visiting for more exciting and free advise.‚

Financial products with less risk and steady growth

Recent Comments