This blog has originally been published on EBN

In recent times, there is a growing concern about the state of the global semiconductor ecosystem. The entire economic structure that was supposed to lead to next-generation manufacturing technologies like 450mm wafers, extreme ultraviolet (EUV) lithography, and transistor technology nodes below 14nm CMOS is on the verge of coming apart.

Whether it is transition to 450mm wafers, higher power requirements for EUV lithography, or shrinking transistor dimensions for keeping up with progress of Moore’s Law, the problems facing the semiconductor ecosystem are essentially the same. Increased manufacturing costs that result in poor return on investment threaten our progress.

When I decided to author my newly released book Mass Capitalism: A Blueprint for Economic Revival, I wanted to provide technology-based free-market solutions to a broader US economy, which is the epicenter of global capitalism. It was a daunting task for a person with just a graduate degree in Electrical Engineering from Texas Tech University, but no formal education in macroeconomics, to write a book on the macroeconomics of the microelectronics industry.

Today, my book is in the hands of not only engineers and scientists but also economists around the world. In addition to offering solutions for the revival of the US semiconductor industry and economy, I also provided a few insights for sustaining the progress of Moore’s Law, along with major macroeconomic reforms in the US economy. These reforms can be applied across the world for sustainable economic progress of Global economy and Global semiconductor industry.

Whether you take into consideration 450mm silicon wafers, EUV lithography improvements, or scaling transistor geometries, from an economic standpoint there is one thing that is common in all three, their respective contributions to the supply of silicon into the economy. While 450mm silicon wafers would increase the diameter of wafers for mass production to reduce the costs, the increased yield from larger wafer sizes contributes to an increased supply of silicon. When it comes to EUV, no one, including lithography systems maker ASML, has yet demonstrated an EUV tool capable of providing the necessary source power concentrations for sustaining production volumes.

This progress of EUV lithography would again make a contribution to only supply of silicon wafers. The relentless progress of Moore’s Law since Gordon Moore made his famous observation in 1965 has essentially been reducing manufacturing costs by scaling geometries, thereby reducing prices for consumers while providing silicon with higher performance.

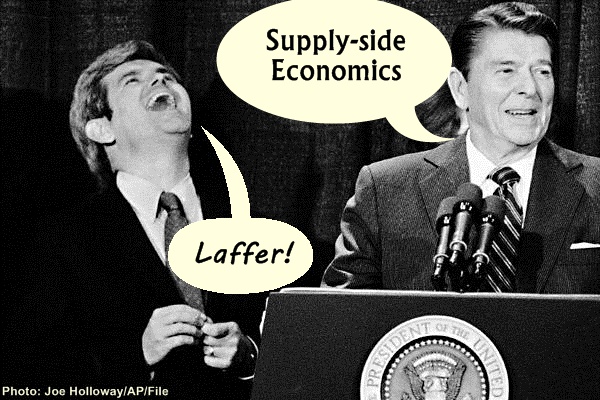

The progress of Moore’s Law has essentially been the progress of supply-side economics. There has been little to no incentive to boost consumer demand in the US as well as global economy besides luring consumers into an unsustainable debt. The term “supply-side economics” was thought, for some time, to have been coined by journalist Jude Wanniski in 1975, but this term “supply side” (“supply-side fiscalists”) was first used by Herbert Stein, a former economic adviser to President Nixon, in 1976, and only later that year was this term repeated by Jude Wanniski.

Its use connotes the ideas of economists Robert Mundell and Arthur Laffer. Supply-side economics is likened by critics to “trickle-down economics,” a theory that believes money trickles down from the producers to the consumers. Trickle-down economics advocates that producers are job creators in an economy and hence it supports giving tax cuts to the producers as a way to boost economic growth so that producers can hire more employees. There is a flaw in this approach because if the producer is not able to sell what he/she has already produced, why would the producer consider hiring more employees (with an incentive of tax cuts) if the consumer demand for his produce does not increase?

In an interesting article, “Reagan: The Great American Socialist,” economist Ravi Batra argues that the supply-side economic policies adopted by Ronald Reagan’s economic advisors in 1981 resulted in budget deficits soaring from 2.5% of GDP to more than 6%, alarming financial markets, sending interest rates sky-high, and culminating in the worst recession since the 1930s. Reagan’s supply-side economic policies resulted in the wealthiest facing a 28% tax rate, while those with lower incomes faced a 33% rate. In addition, the bottom rate climbed from 11% to 15%.

This is how supply-side economic policies since their inception have increased the income disparity across US and global economy. This is verily why free market capitalism has been transformed into crony capitalism over years, which is now bringing the global economy and global semiconductor industry to a standstill due to poor consumer demand resulting from a poor return on investments.

We need to implement economic solutions for sustaining the progress of Moore’s law through establishment of a true free market economy where the real job creators in the economy are not only producers but also consumers. Without a healthy consumer demand for the latest and greatest electronic products, any further investments towards the progress of Moore’s Law, transitions to 450mm silicon wafers and EUV lithography improvements, are bound to provide a poor return on investments for the producers.

If free market economic reforms can usher in a healthy consumer demand for products, then return on investments for producers can also be ensured. Hence, we can conclude that the slowing of EUV rollout, halting of 450mm wafers, and uncertainty beyond 14nm is essentially a failure of supply-side economics, and is definitely not an end of Moore’s Law.

With this in mind, I have undertaken the next venture of authoring another book titled “Sustaining Moore’s Law: Uncertainty Leading to Certainty.” I hope to provide specific industry solutions to envision a sustainable economic and technological progress of Moore’s law. This book will also offer solutions for an exponential growth of Internet of Things (IoT) sector resulting into a broader macroeconomic growth and broad prosperity.

I believe in Ravi Batra’s forecast that a new Golden Age will start in America sometime in 2016, after the demise of crony capitalism, thereby solving the problem of unemployment by the restoration of free markets. Let me know what you think in the comments section below.

Recent Comments