This has been originally published on EBN

The semiconductor industry has a potentially critical part to play in mitigating the effects of the natural macroeconomic cycles that occur in the United States economy.

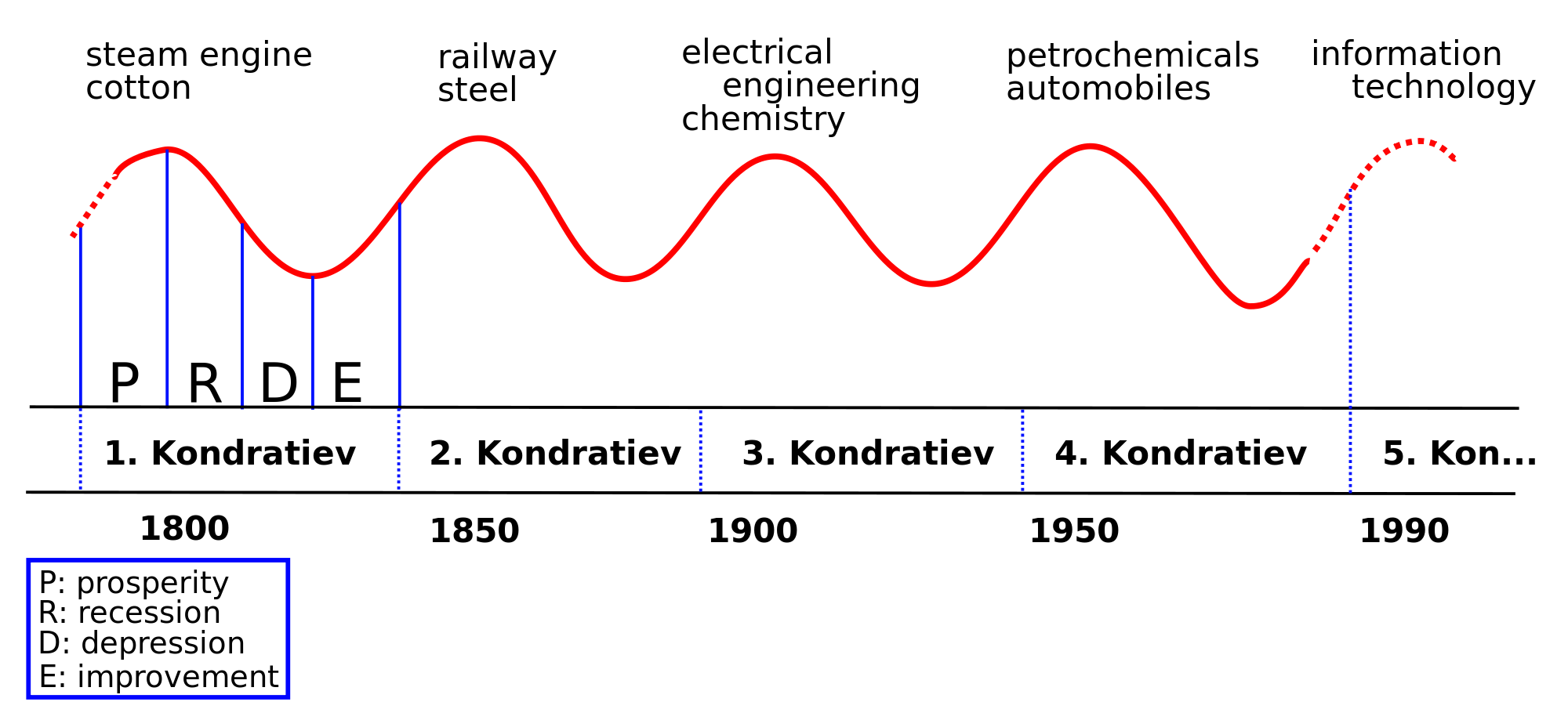

As explained in my previous blog, these macroeconomic cycles, which last seven years to 14 years, are beyond the control of any human being, corporation, or nation. We need a business model for the semiconductor industry that takes into consideration these cycles, and avoids a huge unemployment during economic downturns. Of course, high unemployment created during an economic downturn translates into substantial costs for the government in providing unemployment benefits.

As the government works minimizing spending during an economic downturn, we must also work to minimize the problem of unemployment. Hence, the semiconductor industry business model should be able to establish a free market economy where wages of employees automatically catches up with employee productivity in spite of economic downturns. Only when the wages catch up with productivity can supply and demand grow or fall in proportion. When this kind of a balanced economic growth is achieved, there would be a minimal overproduction of electronics in an economic downturn.

By minimizing the overproduction of electronics, layoffs could be avoided. As I explain in my article A Failure Analysis of US Economy, layoffs occur when real wage fails to catch up with productivity and poor consumption overproduction of goods. On my recent trip to India, a local television station interviewed me about the state of India’s economy and India’s Budget 2015. I was also asked about how India’s “Make in India” policies and solutions sustainably create jobs. In this interview, I made a forecast about the coming global macroeconomic crisis, which I predict will happen by end of 2015 and which will be far severe than 2008 global financial crisis. You can view the video below (It is conducted in the Marathi language).

In Mass Capitalism: A Blueprint for Economic Revival, I proposed blueprint for revival of US economy and particularly its semiconductor industry. In this book, I analyzed the existing economic models in U.S. semiconductor industry from a macroeconomic perspective. Based on this analysis, I was able to put forth a free market business model which would ensure broader prosperity and growth of entire industry and change the thought process of the semiconductor industry professionals that it will be physics and not economics which will eventually lead to the demise of Moore’s law. In this proposed new business model, the existing defects in present fabless-foundry business model which result in trade and budget deficits have been rectified. It also ensures a robust free market balanced economy that would boost the consumer purchasing power of economy.

When consumer purchasing power in the economy increases, then economic demand grows. This ensures that the consumers spend more money into the economy, which encourages the producers to make investments that would cater to growing consumer demand. This kind of co-operative interaction between producers and consumers creates jobs in the economy.

This is how the real job creators in a free market economy are not only producers but also consumers. Since, there is a growth of real wages in the economy, as compared to growth in demand from a growing consumer debt, this economic growth is very sustainable. This was precisely the miracle that occurred in United States from 1950 to1970 when there was a 4% year over year growth in its gross domestic product (GDP), considered as the golden era of free market capitalism.

When the semiconductor industry transitions to the three-tier fabless-foundry business model for sustainable progress of Moore’s law on economic front, this model would also eliminate any problems of unemployment created due to the macroeconomic cycles. The absence of middle industrial tier in the present economy means that there is no premonition of changes happening at a macroeconomic level.

So far, the US semiconductor industry has not been able to solve the problem of unemployment. Meanwhile, a microelectronics revolution has achieved two to four times the relative impact on U.S. economy compared to the impact of the steam engine revolution almost 250 years ago. If the global semiconductor industry does not transition to a three tier fabless foundry business model, the profitability from the progress of Moore’s law get stalled due to poor consumer demand and, based on the macroeconomic cycles, the U.S. economy would take nearly 14 year longs to come out of its economic depression due to a growing gap between wages and productivity.

Recent Comments