By Apek Mulay and Dhanjoo N. Ghista

I. Introduction

During the recent great recession since 2007, many observers wrote the American Manufacturing Obituary, claiming that American could no longer be regarded to be a world leader because of intense competition from low-cost competitors [11]. Trade liberalization has increased the economic interdependence among nations. Multi-National Corporations (MNCs) in US have established operations in developing counties where labor is cheaper. ‚ One consequence of this increased Globalization of manufacturing industry has been movement of jobs and production from U.S. to Low Labor Cost (LLC) countries (which are often less developed countries) for higher corporate profits. This practice is called Offshoring, and is a direct consequence of Monopoly Capitalism, where the prime motive is corporate profits without consideration of job losses for people in the home regions. Globalization works to the detriment of American workers and reinforces unfair labor competition because of lower wages and inadequate working conditions existing in developing nations [10].

The term ¢‚¬ËœOffshoring¢‚¬„¢ is used interchangeably with the term ¢‚¬ËœOutsourcing¢‚¬„¢, but there is a fundamental difference between these two terms:

- Outsourcing refers to movement of jobs and tasks from within a firm to supplier firms, without regard to their location [12].

- Offshoring refers to movement of entire operation of a companies (and jobs and tasks) from one country to another [12].

Semiconductor investment is often considered to be an investment in ¢‚¬Å“enabling technology¢‚¬, which leads to advances in new technological consumer products like computers, cell phones, motor vehicles, etc. which improve the quality of life of human beings often at faster speed of operation and with lower costs [10]. The semiconductor industry includes academic research on semiconductors and related industries like computers, communications and software. Using total factory productivity as a measure of innovation, over the period from 1960 to 2007, innovation in the Semiconductor industry grew close to 9% per year, 25 times the innovation growth rate for the economy as a whole, and accounted for close to 30% of aggregate economic innovation [10]. By sector, semiconductor deepening accounted for 37% of the growth in labor productivity in the Communications Equipment industry, 25% of the growth of the Other Electronic Products industry, 14% of Educational Services, and 9% of labor productivity growth in the Computer and Peripheral Equipment industry for period 1960-2007 [15]. In the post World War II era, US was a role model to the world. The scientific and technological developments that occurred in US post-world war II paved an economy which the world tried to emulate.

The invention of the Integrated Circuit by Jack Kilby from Texas Instruments Inc. and Robert Noyce from Fairchild Semiconductors Inc. made it possible for human beings to send man onto the moon. The US economy in 1950s-60s elevated the standard of living of overall America, by strengthening its middle class with high paying jobs. That era was considered to be the golden era of America. With new technological innovations in semiconductors and related fields, US became the first country to send the man onto moon. Being at the fore-front of technological innovations, U.S. was a powerhouse of creating high paying manufacturing jobs and service jobs.

‚

The globalization of economy started with the intention to supposedly capture foreign markets, but has oddly resulted in the loss of high paying manufacturing jobs from the US to LLCs due to the highly competitive nature of U.S. versus offshore competition in semiconductor technology manufacturing. The present state of US economy has been very discouraging to the millions of Americans who are unemployed. This jobs crisis is a result of diminished purchasing capacity of consumers due to crony Macro-economic policies. With decreased exports and increased imports and the high cost of maintaining US war fronts abroad, there has been increasing budget deficit over the years, causing serious concerns and political tensions.

This political impasse and the current debate regarding achieving a balanced budget with spending cuts and tax increases has prompted us to come up with this article. In this article, we focus on electronics and semiconductor industry, its moving offshore and causing loss of jobs and R & D in it, and offer some insights into: ‚

1)‚ ‚ ‚ ‚ ‚ The causes of the loss of global dominance of US Electronics and Semiconductor industry over years;

2)‚ ‚ ‚ ‚ ‚ How ‚ to fix this problem, that can ‚ contribute towards rejuvenating our economic growth;

3)‚ ‚ ‚ ‚ ‚ How to revive the employment market associated with this industry.

II. Loss of Global dominance of US Electronics and Semiconductor Industry over years

‚

‚ ‚ ‚ ‚ ‚ ‚ ‚ ‚ ‚ ‚ ‚ A 2006 study from the Government Accountability Office (GAO) summarized the offshoring trend in semiconductor industry as follows: ¢‚¬Å“The U.S. semiconductor industry began offshoring labor-intensive manufacturing operations in the 1960s, followed in the 1970s and 1980s by increased offshoring of complex operations, including wafer fabrication and some research and development (R&D) and design work[16].. Semiconductor Assembly and Testing was the first to move to Asia, followed by fabrication and, more recently, by some design operations¢‚¬ [16]. The GAO found out that the ¢‚¬Å“U.S. semiconductor industry has foreign operations in several locations, notably in Taiwan and China.¢‚¬ This is largely because of the government policies in those Low Labor Cost (LLC) countries like Taiwan, China, etc., which ¢‚¬Å“created favorable investment conditions for U.S. semiconductor firms¢‚¬ [16].

The US share of world wafer fabrication capacity fell from 26% in 1994 to just over 20% in 2004[10]. This decline in the manufacturing sector is expected to continue, based on trends in 300 mm manufacturing. According to the Semiconductor Industry Association‚ (SIA), approximately 80% of all new 300 mm semiconductor manufacturing is outside the United States, mostly in Asia (33% in Taiwan, 11% in Japan, 9% in Southeast Asia, 8% in South Korea and 5% in China) and 14% in Europe[10]. Analysts at Goldman Sachs in 2003 estimated that offshore relocations by US MNCs had resulted in transfer of high paying 100,000 manufacturing jobs per year, and this figure does not include the shift in manufacturing to foreign third-party contractors [3]. This paradigm of sending jobs offshore in very capital-intensive semiconductor manufacturing business is happening in spite of labor being insignificant part of total operating costs for a semiconductor wafer foundry.

The ¢‚¬Å“Y2K concerns¢‚¬ led to the offshoring of relatively high skilled, high wage information technology jobs related to semiconductor industry, such as programming and software development, with India as the prime beneficiary [10]. Of course, credit goes to India for producing talented software programmers who were readily available to perform these offshored jobs of good quality but at much lower wages compared to their American counterparts.

Although there are no publicly or privately funded national surveys that systematically collect information on the number of jobs that are moved offshore, the reports of offshore outsourcing by media are incomplete, since many firms avoid disclosing reasons for closure or transfer of specific operations [10]. A small and incremental offshoring by MNCs may go un-noticed by the media. Additionally, expansion of business operations overseas (rather than domestically) by MNCs in U.S. is frequently overlooked by the media even though that involves unemployment of existing workers[10]. According to the U.S. Bureau of Labor Statistics, the great productivity increases that have taken place in manufacturing sector further complicates our ability to fully understand the contribution of offshoring to job losses[10]. The technological advancements in development of advanced methods of production, information and communication technologies have made it possible to manufacture the same amount of goods and to provide services to the customers but with a fewer number of workers.

When studies were done in past regarding the trends of jobs being offshored from the US, it was concluded that jobs with lower skill set and lower wages were more at risk of being outsourced offshore. The studies also suggested that jobs that commanded higher salaries and required better skill sets were relatively immune from being offshored as they needed an advanced education. According to the findings of Alan Blinder, there was no relation between occupation¢‚¬„¢s skill level or educational requirement and its potential risk to be outsourced offshore. Blinder estimates that 42 to 56 million U.S. jobs are at risk of being outsourced offshored over next two decades [4].

III. Background of Offshoring

Since the end of World War II, trade agreements, such as General Agreement on Tariffs and Trade (GATT) and later World Trade Organization (WTO), have promoted ¢‚¬Å“Free Trade¢‚¬ by lowering and abolishing trade barriers between member countries, including the United States[10]. In the Post World War II period, America was the sole survivor from war devastations as compared with countries in Europe and Asia. Hence, US companies had virtually no international competition when it came to high tech manufacturing, except to competition from Soviet Union. Free Trade then was very beneficial for US corporations, as all manufactured goods from US were able to compete freely around the world, as there was no import duty placed on these goods as a result of ¢‚¬Å“Free Trade¢‚¬ agreements.

Over the years, the countries devasted during World War II regained their footing, and their economies started to revive and grow. During the 1960s, semiconductor manufacturing jobs were the first wave of the jobs to be outsourced to countries like Japan in the bid to reduce production costs and increase efficiency [10]. During the 1960s, since the tax structure of America was a progressive tax structure, the tax rates on wealthy were very high. It was under a republican President Eisenhower that the top 1% of America paid a highest tax rate of 92%. As a result of high taxes on the wealthy, the sales tax, payroll tax, social security taxes were very low. These taxes fall on the middle class Americans. Hence, the consumer purchasing capacity of the middle class was high, and consequently the economy was strong.

As a result of high consumer purchasing capacity, the domestic demand for American manufactured semiconductor goods and services was high. Therefore, the year over year growth in GDP was high, and offshoring semiconductor manufacturing to Asia did not quite hurt the domestic economy in the U.S. However, the Global competition and aggressive export-driven growth policies adopted by other countries have had a negative impact on the U.S. semiconductor industry. International trade today plays a much larger role in American economy today than it did just 20 years ago [10].

IV. Bane of Offshoring: Date on Employment Loss and Increased Poverty

According to estimates by Goldman Sachs, Offshoring has accounted for roughly half a million layoffs in the past three years. According to IT consulting firm Forrester the number of U.S. jobs outsourced to grow from about 400,000 in 2004 to 3.3 million by 2015. If this estimate turns out to be accurate, then offshoring could result in roughly 250,000 layoffs a year [2].

Indeed, a recent study by Ashok Deo Bardhan and Cynthia A. Kroll at the University of California, Berkeley, suggests that up to 14 million Americans now work in occupations¢‚¬including financial analysts, medical technicians, paralegals, and computer and math professionals¢‚¬that could reasonably be considered “at risk.” [2]. This accounts for a substantial 10% of the total US employment of 137 million. When one can empathize with the workers who lose their jobs, and to the far larger number of workers who worry that they will lose theirs, this foreign outsourcing total resonates even more powerfully [2].

Now highly qualified workers in the developing world are competing with college-educated American workers. The Business Week’s chief economist, Michael Mandel, worries that the “skills premium” that educated workers earned in the past may be pushed down further in the future, thus reversing a decades-long trend. Some workers could suffer erosion of their wages when their jobs are vulnerable to offshoring. Thus effects of outsourcing offshore would resonate across a broad spectrum of society.

Offshoring and outsourcing has greatly affected the inequality between Blue and White Collar occupations, as depicted in Table 1. Furthermore, the imported inputs share of total inputs produced by industry increased by 9.6 % over a 15 year period from 1987 to 2002, thereby causing increased poverty.

|

Manufacturing |

Services |

| Impacts blue-collared jobs | Impacts white collar jobs |

| Affects individual industrial sectors and some specialized occupations within them | Affects individual occupations in many industrial sectors across the economy |

| Job losses offset and even reversed by increases in services employment | May lead to different composition in the economy; unclear how the labor market adjustment will work |

| Has led to increased inequality between blue-collar and white-collar occupations | Will lead to increased inequality within white collar occupations |

Table 1: Impact of Outsourcing, ¢‚¬ËœFischer Center Research Reports¢‚¬„¢ ¢‚¬œ The New wave of Outsourcing [2]

|

e North American Industrial Classification System (NAICS) |

1987 | 1992 | 1997 | 2002 |

% Change 1987 -2002 |

|

Paper |

10.5% | 9.4% | 13.2% | 13.2% | 2.7% |

|

Printing and related products |

1.1% | 1.1% | 3.1% | 5.7% | 4.6% |

|

Chemical |

8.3% | 10.7% | 14.8% | 19.3% | 11.0% |

|

Primary Metal |

16.2% | 18.0% | 20.6% | 22.7% | 6.5% |

|

Fabricated Metal product |

6.8% | 5.7% | 7.6% | 9.5% | 2.7% |

|

Machinery |

17.5% | 21.8% | 23.7% | 27.1% | 9.6% |

|

Computer and Electronic Product |

23.4% | 30.1% | 42.5% | 45.3% | 21.9% |

|

Electrical equipment, Appliances and Components |

11.6% | 16.3% | 22.4% | 31.5% | 19.9% |

|

All Manufacturing |

11.2% | 12.9% | 18.7% | 20.8% | 9.6% |

Table 2: Imported inputs as share of total inputs produced by industry, 1987-2002. This table points to the fact that Outsourcing offshore causes increased poverty due to increased annual imports [29]

V. Causes of Outsourcing Offshore

The decision to outsource jobs is a complicated decision rooted in the strategic plan of a company. There are four types of Outsourcing in the case of semiconductor industry, as mentioned below:-

- Direct Outsourcing ¢‚¬œ In this type of outsourcing, a semiconductor company in US makes use of in-house low cost offshore location. Although this requires large investment, in the long run it is still able to retain jobs within the country and has the least risk. However, if US MNCs manufacture products abroad, by making use of low wages of LLCs and then sell the manufactured goods back into the U.S., this process adds to trade deficits [13]. In the long run, it might be riskier as eventually most of jobs from U.S. would be offshored to LLCs.

- Joint Venture Outsourcing ¢‚¬œ Joint venture outsourcing refers to partnership between a domestic institution and a foreign vendor which could be risky if the domestic institution does not have majority in the investment. However, it should be noted that due to rising trade deficits with China, today China withholds trillions of USD in FOReign EXchange (FOREX) reserves. Eventually, due to huge withholding of US debt, China would even be able to dominate US foreign policies [13]. Hence, Even Joint Venture Outsourcing can slowly but steadily be risky for not just US domestic economy but also for its foreign policy independence.

- Direct Third Party Outsourcing ¢‚¬œ In this type of outsourcing, jobs or services are outsourced to a third party offshore and can only control what is contractually agreed upon. This type of offshoring is riskier as U.S. can enforce its Intellectual Property (IP) laws strictly on companies doing business in U.S. However, these laws cannot be enforced in other countries, which do not fall into its jurisdiction (especially in those countries which are major creditors of U.S. Debt like China). In such a scenario, it becomes possible for the third party to misuse the IP of semiconductor companies in US in some other products which are sold domestically in that country [19]. This shows how direct third party outsourcing offshore is risky for IP security of companies offshoring their products and services.

- Indirect Third Party ¢‚¬œ In this type of outsourcing, jobs or services are outsourced to a domestic vendor, who then subcontracts the work to another vendor offshore. This is by far the riskiest type of outsourcing. Initially, the United States manufactured all defense-related products at home. However, consumer electronics are being built in China due to its low cost of labor.‚ As technology progressed to advanced transistor technology, it required a big ‚ investment from defense contractors, who work for profit, to manufacture semiconductor wafers in the United States due to much needed proximity between ¢‚¬Å“Labs and Fabs¢‚¬ for advancements in semiconductor manufacturing technology. Hence, several defense contractors started to use Chinese built ICs for military weapons like missiles and machine guns. Along with the state-of-the-art infrastructure, the technical know-how to make advanced technology products has also been transferred to China. So now China is flooding the U.S. defense supply chain with counterfeit ICs [19]. This has become a US national security threat, which is being kept somewhat secret from the public due to the dominating control of corporations on US government in this Corporate Capitalism era.

Some of the reasons, that companies decide to outsource, include [17]:

- Mitigation of Risks

- Improving quality of‚ products and services

- Faster timing to market

- Obtain new ideas or thinking

- Rapid expansion of Capacity

- Focus on core competencies growth with less investment

- Infuse companies with new technologies

- Leverage company¢‚¬„¢s assets and capabilities

- Better cast flow, and

- Reducing costs

What leads to outsourcing offshore of semiconductor manufacturing jobs?

The answer is cost differentials: it costs manufacturers roughly $1 billion more to build wafer fabrication facility in the United States ($6.7 – $6.8 billion) than in foreign LLC locations ($5.6-$6.1 billion) [10]. Labor cost is thus a secondary issue for semiconductor manufacturers, accounting for only 10% of cost differential, and still manufacturing jobs are being outsourced offshore. When it comes to semiconductor manufacturing, the costs of operations, materials and capitals are somewhat similar in other LLC locations to those in USA. According to SIA, the manufacturing in LLCs is profitable compared to US due to much better tax benefits and more generous capital grants offered offshore by LLCs as compared to what the US government offers [10]. So this is the issue of governmental policy not rising to the occasion of matching the benefits meted out to MNCs in LLCs.

For example, Israel offers the semiconductor industry a capital grant of up to 20% and 10% tax rate with a two-year tax holiday [10]. China allows a five year tax holiday and levies only half the normal tax rate for 6 to 10 years. Ireland has 12.5 % corporate tax rate; Malaysia offers 10 year tax holiday. The 35% federal corporate tax rate in US is not competitive compared to these offshore incentives [10]. The United States semiconductor industry invests 17 cents on every dollar of sales in Research & Development (R&D), and is criticizing the failure of Congress to make federal R&D tax credit permanent [10].

In spite of only 10% manufacturing and labor cost differential between US and other countries, the supporters of Offshoring have deceptively argued that high foreign incentives is a plus for United States, since it allows American companies to focus on design, with the capital intensive production being subsidized by another country. However, the physical proximity of ¢‚¬Å“labs and fabs¢‚¬ is even more important for chip manufacturing complexities in nanoscale engineering [10]. Due to this reason, the related jobs such as chip layout, failure analysis, testing, assembly, etc. have also been transferred to low cost countries in Asia causing massive job losses in US.

VI. Solutions to Rejuvenating US Electronics and Semiconductor Industry

The issue of offshoring demands a careful analysis and response by policy makers. It has to be ensured that any potential benefits are equitably distributed among the firms and workers. While offshoring has substantially saved costs and also increased the corporate profits of MNCs, it cannot be assumed that these benefits would scale up for broader economy at both the micro and macro economic levels. While mainstream international economists teach that a deepening international integration usually increases national income, the observed effects on high consumer debt of middle class Americans and the country¢‚¬„¢s high national debt show otherwise. Although Offshoring may have increased incomes of companies, it has affected national income, because of the high unemployment of American workforce and their inability to pay taxes and also being on welfare.‚ This is the short-sightedness of American multinationals that have only looked after their corporate profits and ignored the unemployment and national income loss.‚ This is verily the downside of Crony (Corporate controlled) Capitalism, which is being cunningly and shamefully ignored. What may be good Micro-economically may not always be good Macro-economically.

Mainstream international economics is equally clear that international integration redistributes incomes than it creates. The growth in GDP may seem to be artificially portrayed as high due to offshoring, but American workers have been losers at the expense of higher corporate profits. Unemployment has many negative effects on its ¢‚¬Ëœpatients¢‚¬„¢: (i) loss of their housing, lower consumerism on their part, lower education for their children, increased health effects, (ii) greater national welfare costs, and above all (iii) marked prevalent depression among the unemployed.

A good economic policy should not rest on insisting workers to sacrifice their own interests by accepting lower wages and benefits for supposedly increased national income [3]. This also throws light on the need for better metrics for measuring Macro-economic growth as compared to traditional methods of measurement in terms of the Gross Domestic Product (GDP). A good economic policy measure should also be able to take stock of the unemployed percentage and address the problem of loss in manufacturing jobs due to rapid advances in productivity due to advances in technology [18]..

Before arriving at solutions to rejuvenate the US Semiconductor industry which is on its death bed due to its offshoring, it is critical to compare the pros and cons (in terms of micro-economic factors) of offshoring of the US Semiconductor industry and associated outsourcing of US semiconductor manufacturing jobs offshore.

|

Micro-economic benefits of Outsourcing Offshore by proponents of offshoring.

|

Our analysis on proposed benefits |

| Semiconductor companies save on labor costs and incur less regulation. | While labor costs are low in less developed countries, the jobs offshored lead to massive job losses at home, creating a long term problem of domestic unemployment, due to short sighted thinking of short term profits |

| Offshoring increases MNCs productivity and increases their corporate profits for more investments into R&D. | The increase in productivity can be sustained even without offshoring. Also, it is not good economic policy to take into consideration the growth of only supply side of economics due to increased productivity, without ensuring a sustainable domestic demand for manufactured products, which causes layoffs at semiconductor company.The US government could provide generous tax credit for R&D so that corporations do not have to offshore jobs to raise that money for R&D investments. |

| Offshoring gives U.S. companies access to talented individuals abroad at even lower costs. | Offshoring also causes the domestic economy to slowdown, as less job openings are available for new college graduates and existing employees have to take pay cuts which is evident from the exponentially rising productivity and stagnating wages of the US work force since 1980s.[13] |

| MNCs which offshore jobs claim that by hiring native born employees in other countries helps the firms in adjusting to their new market¢‚¬„¢s customs and traditions [10].. | It is true that native born employees help firms in adjusting to new market¢‚¬„¢s customs and traditions, but these firms could also gain access to new markets by retaining the high quality of products. Which consumer would not like to get the best quality of product? Additionally, by entering into new markets, rich corporations eliminate small businesses which are not able to compete with low prices offered by MNCs which also leads to monopolizing the new market. Any kind of monopoly could, over time, erode local customs and traditions in the new market. |

| Offshoring allows 24 hour functionality and enables work round the clock. Production can be coordinated in all global time zones [10]. | This round the clock work schedule also leads to longer work weeks and affects the health of employees in US who have to co-ordinate with their peers in other time zones around the globe to meet with deadlines. |

| Supporters of Offshoring claim that this trend helps constrain inflation by allowing Americans to buy lower cost semiconductor products like cell-phones, tablet PCs, hybrid cars, etc. which then improves U.S. standard of living [10].. | If any country has a trade deficit (where imports are larger than exports), it leads to a fall in the country¢‚¬„¢s FOREX (FOReign EXchange) reserves (which eventually depreciates its currency). The value of a country¢‚¬„¢s currency is a deciding factor in its standard of living. Hence, a country cannot run year-over-year trade deficits if it wishes to maintain the standard of living of its citizens. FOREX reserves determine the buying power of a country¢‚¬„¢s currency.Let us take an example of a country ¢‚¬ËœA¢‚¬„¢ where its population has sufficient purchasing power and can buy everything produced in the nation. But there are some products that are not produced at home and have to be imported from another country ¢‚¬ËœB¢‚¬„¢. Hence country ¢‚¬ËœA¢‚¬„¢ has to pay money [in its currency] to buy country B¢‚¬„¢s goods. Either country ¢‚¬ËœA¢‚¬„¢ has to balance its trade by getting country ¢‚¬ËœB¢‚¬„¢ currency from a third country ¢‚¬ËœC¢‚¬„¢, or go on printing its own currency. But there is a limit that country ¢‚¬ËœB¢‚¬„¢ will accept country ¢‚¬ËœA¢‚¬„¢¢‚¬Ëœs printed money. After that country ¢‚¬ËœA¢‚¬„¢ will have to produce the items within the country, causing huge inflation due to the depreciated value of its currency resulting from excess money printing. [13] |

| MNCs claim that the U.S. government gains leverage in efforts to convince foreign governments to allow foreign firms to buy US manufactured goods and services [10]. | Firstly, as a result of offshoring high paying semiconductor manufacturing jobs abroad, the manufacturing base in US has depleted. Hence, it is incorrect to claim that the goods of MNCs based in US are US manufactured goods. In fact, they are foreign manufactured goods and as a result of job losses at home, US consumers are left with no other choice but to buy cheap imported goods due to their depreciated consumer purchasing capacity. |

| Proponents of Offshoring claim that this trend of offshoring also strengthens the economies of developing countries and enables them to buy more US made products, provided adequate wage, safety and health standards are raised abroad. | While there is no doubt that offshoring has strengthened the economies of countries like China, but at the cost of rising consumer and National debt in US. Additionally, the depreciation in consumer purchasing capacity of Americans have forced majority of US consumers to buy imported cheap goods from China, which is also hurting domestic US economy as 70% of US economy depends on consumer spending. [13] |

| Proponents of offshoring claim that the unconstrained ebb and flow of capital, goods and services would be able to beneficially serve US economy as US would remain center of Innovation [10]. | With outsourcing of high tech semiconductor manufacturing to LLC, the US is no longer the center of Innovation. According to Dr. Richard Haas, Chairman of the Council of Foreign Relations, China¢‚¬„¢s ownership of trillions in FOREX is a great threat to the United States, as China, with vast FOREX reserves, is in a position to influence US foreign policies through its control over the value of US currency. This is similar to the way the United States was able to dominate the foreign policies of Britain and France after World War II and forced their troop withdrawal during the Suez crisis purely because of its ownership of British and French debt. [13] |

Table 3: Our Analysis of the proposed micro-economic benefits of Outsourcing Offshore by proponents of offshoring

Based on our analysis it is clear that any form of offshore outsourcing threatens the US economy. This is how ¢‚¬ËœGlobalization of Industrialization¢‚¬„¢ has been a great American deception. However, we have only analyzed the pros of the proponents who claim that outsourcing semiconductor manufacturing jobs offshore benefits overall US economy. Let us also mention the Macro-economic dangers of this practice of outsourcing jobs offshore.

- This trend of Offshoring is eroding US leadership in technological fields. As offshoring becomes more common, foreign firms and workers are becoming more sophisticated. Then, US will no longer have technological leadership; also it will pose a security risk for United States when its technical leadership is lost and there is increased dependence on foreign firms for the services they provide US.

- The domestic small businesses which have been supplying to firms that have now moved offshore would be hurt because of loss of market for their products and services [10]. This has a much larger long term impact on domestic economy, which was not well thought off for short term corporate profits.

- High technology semiconductor manufacturing jobs lost are likely to be replaced by jobs in service-providing industries which offer much lower pay and benefits which not just harm the displaced workers but also hurts domestic economic demand through reduced consumer purchasing capacity.

- Offshoring threatens upward mobility for majority of US workers who considered post secondary education as route to higher standard of living [10]. It also hurts human capital level, by reducing university enrollments in certain engineering fields where employment opportunities have been reduced by offshoring.

- A good economic system ensures prosperity for all citizens by making use of individuals¢‚¬„¢ best abilities in making a fruitful contribution to economy. The disruption of workers due to offshoring lower level jobs creates a mismatch between demands of businesses and skills of individual workers [10]. In such cases, businesses have to spend additional money in training the displaced workers.

- Due to lower wages despite increasing productivity, American workforce may be expected to place more demands on unemployment benefits and similar social programs requiring US government to run further budget deficits which adds to country¢‚¬„¢s National Debt.

- An Offshoring of hi-tech job from US also adversely affects IP security due to less stringent regulations and less strict Patent law enforcements in developing countries [10].

- Sub-contracting of offshored work also causes offshoring of liability when it comes to maintaining quality, security and integrity of products and services. Additionally, it also complicates the supply chain and makes it difficult for company¢‚¬„¢s management to exercise control and supervision over work. This threatens introducing counterfeit products into the US supply chain from independent foreign contractors [19].

- With just 10% differential in labor costs in semiconductor manufacturing, outsourcing offshore also adds costs of transportation of finished products which reduces the profit margin further for US semiconductor manufacturing companies [10]. The lost tax revenue from unemployed and the increased need to make use of the social benefits by unemployed Americans offsets the 10% differentials gained in labor costs gained through outsourcing offshore. This raises serious questions about the benefits of outsourcing offshore to overall US economy.

- Any kind of ignorance or bad decision when it comes to taking into consideration local customs and culture, political and military stability and legal enforcements to protect IP could make this process of offshoring very expensive and it would be doomed to failure [10].

- There is a lack of control in avoiding sweat shops in offshored Developing countries. Also the demands from Wall Street for seeking higher corporate profits are likely to continue this trend of outsourcing jobs offshore. But this would very likely create a backlash not just in domestic US economy against the corporate greed, but would also create an anti-American sentiment in third world countries wherein laborers are exploited due to less stringent domestic labor laws and poor working conditions.

VII. Policies Reforms to revive the employment market in US associated with the Semiconductor industry?

¢‚¬ËœGlobalization¢‚¬„¢ was conceived to enable American companies to enter other countries¢‚¬„¢ markets and thereby enhance US economic dominance.‚ However, this has resulted in a backlash and now found to be clearly a deceptively defective economic policy, which has resulted in loss of dominance of US economy and transferred the dominance to LLCs like China. The acute unemployment in US caused by ¢‚¬ËœGlobalization of Manufacturing Industry¢‚¬„¢ needs both (i) short term fix in order to rejuvenate its electronics and semiconductor industry, and (ii) long term fix to avoid such an economic blunder in future.

Reform policies for the Manufacturing Industry have to ensure that America is able to retain the status as most attractive location in world for high-tech manufacturing and high-value services. The Policymakers should view under a sharp eye the distortions in country¢‚¬„¢s tax code that may artificially encourage offshoring. US tax policies which permit deferral in taxation on foreign earnings but not domestic earnings is one of causes of high corporate tax rates in America. Recent proposals that would end the preferential tax treatment of foreign earnings and lower the corporate tax on domestic earnings merit special attention [30].

‚

It is also very important to strengthen R&D for creating more entrepreneurs and more jobs in near future.‚ Instead, recent budgets have cut federal support for R&D in engineering and the physical sciences relative to the size of the economy. Finally, it is important to reduce reliance on an employer-based system of health insurance that adds to costs of U.S. firms and to the overall insecurity of displaced workers [30], and adopt the Obama Healthcare system.‚ .

In order to cultivate a competitive and highly skilled workforce, it is important to strengthen kindergarten through twelfth-grade curriculum, invest in science and engineering (or STEM) higher education, and restore funding to community colleges and retraining programs that have suffered large cuts in recent years. US will not be able to hold onto the highest paying jobs in the world if the number of college graduates with degrees in physical sciences, math, and engineering continue on a downward trend [30].

Designing policies to strengthen the skills of the American workforce is particularly critical because the American economy is likely to confront a rapidly increasing skill shortage on the heels of the offshoring debate [30]. In separate reports, Anthony Carnevale and Donna M. Derochers of Educational Testing Service and David Ellwood of Harvard University have written about a looming “skilled-worker gap” forecasting a gap of 5.3 million skilled workers by 2010 and 14 million by 2020 [30]. This is attributable to both aging American workforce and to the expectation that increases in average educational attainment achieved over the past two decades will level off over the next two decades, even though the demand for skills continues growing at a rapid pace.

Indeed, strategic government policies with respect to education, workforce training, tax reform, trade reform, economic reform and immigration reform can have considerable influential effect in attracting both domestic and international human capital to in turn promote innovation. Such policies can rejuvenate the industry by spurring innovation and world class R&D and also prepare the work force for future. We propose the following policies to revive the employment market in US associated with Semiconductor industry.

Education Policies

‚

A 2006 GAO study noted that the ability of US to compete depends on its R&D investments, innovation in academic environments through best and brightest students and competitive business policies which encourage entrepreneurship [16]. Hence, School Education should have emphasis on STEM (Science, Technology, Engineering and Math) education at all grade levels [10]. The school curriculum should be designed such that it incorporates ‚ project-based learning,‚ provides introduction to semiconductor technology, and also includes minor summer internships in semiconductor businesses which form the core of technology development in that area. This would attract, develop and nurture undergraduate and graduate students to participate, direct and lead the development of semiconductor industry in coming years. The government education policies should also encourage collaboration between advanced education institutions and semiconductor companies in order to equip students with (i) right skills which are currently in demand through co-operative internships, and also (ii) ‚ skills that would likely be demanded in future through Corporate-University collaborated R&D programs.

An inculcation of ¢‚¬Å“soft skills¢‚¬ is equally important in work place along with skills in technology. Hence, technology leadership programs should include inculcation of ¢‚¬Ëœsoft skills¢‚¬„¢ as well. Government should enact laws to provide and make permanent R&D tax credit, as investments made by businesses into semiconductor R&D are a significant portion of their business costs [10]. This would help in developing new technologies for a range of applications including consumer electronics, defense, industrial automation, and tools for advancements in nano-manufacturing, etc. This would also encourage entrepreneurship that comes with innovation, including associated manufacturing jobs and related service occupations [10].

‚

University-Industry Collaboration to incubate new companies: Government and industry sponsored scholarship and research grants could attract and retain talented individuals who are essential for semiconductor industry to flourish. One way to increase entrepreneurship is to have co-operative partnerships between Universities and companies. The Universities should device a mechanism by which

- Doctoral students¢‚¬„¢ research can be sponsored by this ¢‚¬Ëœuniversity-companies conglomerate¢‚¬„¢, and then the resulting technologies (developed by the doctoral students) are spun off into new companies which are partly owned by this ¢‚¬Ëœconglomerate¢‚¬„¢ and partly owned by the doctoral students and their supervisors.

- The ¢‚¬Ëœdoctoral students owners¢‚¬„¢ are then free to employ their master¢‚¬„¢s degree graduates in their companies, and implement the system of employee profit-sharing.

‚

Workforce Training Policies

High employment is key to economic stability of any country. Long term unemployment drains the technical skills of unemployed professionals and they need to be re-trained to prepare them for demands of new technology. By collecting unemployment benefits through workforce re-training programs, rather than providing them for free, would eliminate lethargy in work force. This would also give an incentive to the laid off and long term unemployed work force to prepare for the new demands of work force in order to receive benefits of unemployment.

The government should also make efforts to expand awareness of employers about workforce training resources, in order to strengthen human capital of present and future workforce[10]. Providing subsidies to hi-tech companies for creation of quality semiconductor jobs in manufacturing and related services will support families and local economies, and train the incumbent workers for industry demands of new technologies. Global leadership in semiconductor industry requires coordinated strategy in graduate education promotion, economic development and workforce development strategy [10]..

There should also be encouragement and incentives in order to expand military, ¢‚¬Ëœsecond career¢‚¬„¢ workers, and retirees with skills to either remain in labor force or be involved in workforce training [10].

Reforming Tax Policies

The government shall provide beneficial corporate tax policies in order to bolster competition. There should be incentives to make investments in setting up semiconductor wafer foundries and universities in rural areas where the cost of living is lower as compared with big cities. This would reduce the cost differential for capital intensive semiconductor manufacturing plants which are not labor intensive. Hence, labor costs advantages enjoyed by low-wage countries would become less advantageous for companies to move abroad. Tax incentives towards investments in centers of excellence provide location advantage in nanoscale manufacturing which rely on proximity of their ¢‚¬Å“labs and fabs¢‚¬. It should become the role of a democratically elected government to be actively engaged in efforts to strengthen the R&D culture in universities, attract investments that are built on backshoring and insourcing. The US needs to adopt changing legislation that would reduce tax benefits for overseas operations of MNCs. They should be forced to pay the same tax rate as would have been needed to get the same work done domestically. All loopholes in tax structure should be eliminated to avoid offshore tax havens [10].

Along with federal tax incentives, local or state tax incentives toward R&D make semiconductor business competitive compared with generous 5 to 10 year tax holidays provided by developing countries. As advances take place in nano-manufacturing, the tools and equipments also need to be replaced. The government could provide a favorable tax policy that allows accelerated depreciation on these tools and also provide sales tax exemptions if the companies show a proven track record of high employment of its workers [10].

In order to make the university-corporate conglomerates a success in rural areas, there should be a meaningful economic development tax incentive by permitting expedited processing of new semiconductor entrepreneurship projects taking into consideration rapid advances in technologies and production cycles [10].

Trade Policies

¢‚¬ËœFree trade¢‚¬„¢ is the root cause of loss of hi-tech semiconductor manufacturing jobs from US. The U.S. needs to reform its trade policies with LLC countries and need to adopt balanced and ¢‚¬ËœFair Trade¢‚¬„¢ policies to (i) prevent outsourcing and offshoring of jobs, and (ii) make American manufactured goods to become cheaper and more competitive by enhancing the technological level of products and decreasing manufacturing costs (as explained above). This would protect manufacturing jobs in US and eliminate the annual trade deficit of 600 billion dollars [13]. By manufacturing high quality goods, American goods would be in high demand in international markets and it would also mitigate attempts to introduce counterfeit electronics into US supply chain by China, which has become a threat to US National security [19]. Reforming trade policies needs to become absolutely urgent, as ¢‚¬ËœFree Trade¢‚¬„¢ policies in US are creating a perfect storm for its semiconductor industry [13]..

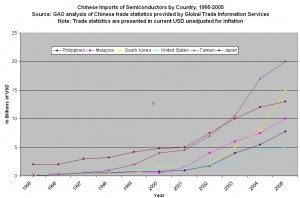

China is the biggest trading partner of the US. The US runs approximately 600 billion annual trade deficit with its trading partners; this is also evident from the huge FOREX reserves (in billions of USD) accumulated by China and Russia over years [13]. In order to reduce its trade deficit with China, US needs to export more goods to China and import fewer goods from China. This increased exports based trade surplus is the only way that US can sustain its Global trade currency through positive balance of payments; the question is how to make that happen. Fig. 1 below shows the Chinese imports of Semiconductors by Country from 1995-2005. It can be observed that US exports to China are less than even exports from Philippines to China. This is the root cause of year-over-year ¢‚¬ËœTrade deficits¢‚¬„¢ and negative ¢‚¬ËœBalance of Payments because of Globalization through ¢‚¬ËœFree Trade¢‚¬„¢ policies in Semiconductor business. This decrease could also be attributed to depreciated manufacturing bases in US as a result of outsourcing offshore of all hi-tech manufacturing jobs.

Figure 1: Chinese Imports of Semiconductors by Country (1995-2005). It can be observed from Fig.1 that US exports to China are less than even exports from Philippines to China [32]. This is the root cause of year-over-year ¢‚¬ËœTrade deficits¢‚¬„¢ and negative ¢‚¬ËœBalance of Payments because of Globalization through ¢‚¬ËœFree Trade¢‚¬„¢ policies in Semiconductor business.

Immigration Policies

The US needs to reform its current immigration policies, in order to reform the abuse of its H1B visa program by guest workers. This visa program could be relied on in order to fill urgent needs for workers on a limited basis. According to Ron Hira of Rochester Institute of Technology, three principal flaws characterize the program at present: absence of labor market test, absence of prevailing wage requirements and deficient oversight [7]. Hence, Policy changes are needed to ensure that:

- US workers are not displaced by H1B workers

- Wages paid to H1B workers are fair compared with their US counterparts

- The H1B workers are provided all safeguards to protect them from any on-job injury, illness, etc.

- Resident visas should be issued to only those candidates who have US equivalent M.S. or Ph.D. degrees so as to keep the R&D program competitive. This would also ensure high enrollment in US universities of talented graduate students around the world.

- Eliminating country based quota for getting permanent residency would also avoid losing talented scientists and engineers from leaving the country due to prolonged delays in processing of their permanent residency.

VIII. Rural Development through Higher Education — To cultivate Technological Industrial development, Attract MNCs to return Home, Create Employment and Promote Economic Rejuvenation [14]

Our rural, urban and national economies are plummeting.‚ More than ever before, our Rural Communities are in dire need for active involvement of universities, through their academic programs, for: (i) encouraging and inspiring students to pursue higher university education to develop their future, while being able to live in their hometowns; (ii) sustaining farming communities, which constitute the base of the rural regions, (iii) promoting innovation and enabling scientific, technological and medical advancements locally, to enrich the rural communities; (iv) cultivating industrial development and creating employment, by attracting companies but essentially by incubating new companies locally; (v) ensuring people of requisite purchasing capacity for their basic needs, while providing scope for their cultural and aesthetic expressions; (vi) developing sustainable rural communities, creating grass-roots economy and providing a healthy lifestyle for the rural population.‚

In this context, the Ozarks Rural University planned by Prof Ghista [31] will provide the requisite knowledge base and human capital for:

- Our farming and infrastructure development and maintenance,

- Creating hi-tech towns and sustainable communities,

- Cultivating locally developed businesses and‚ industry, professional and financial services,

- Providing employment opportunities in all work domains, for people with diverse backgrounds,

- Our wellness and healthcare,

- Bringing economic and functional stability to families,

- Inspiring our children to complete their high-school education and look forward to a fulfilling lifestyle,

- Provide to our families and children a bright future.

So then here is our new Field of Dreams. We propose that rural towns and counties budget for setting up rural colleges and universities, who in turn would also commit to be involved in State infrastructural projects, such as roads, water-supply, sanitation, renewable energy production. This would provide research assistantships for students, and thereby enable engagement of more graduate students, which in turn enhance university R&D and technology development.‚ All of this would provide very attractive rural breeding grounds for hi-tech companies.

Let us hence cultivate our own affordable university education, our own innovations, our own businesses and cooperatively managed corporations, our own employment avenues, our own healthcare delivery system, and our own bright future, by investing just 50 cents a day to set up our own Ozarks Rural University within two years.

Rural regions have marked lower standard and cost of living as well as lower salary scales compared to urban regions.‚ Hence, as proposed above, rural communities (towns and counties) should take upon themselves to (i) establish rural colleges and universities and (ii) thereby make hi-tech human resources available for companies.

As a result, hi-tech companies would want to move back home into rural areas, to take advantage of lower labor costs. The local towns can also consider offering incentives to companies in the form of low land costs, tax benefits, and technologically trained work force availability. The lower operational cost in rural regions can then provide incentives to the MNCs to move back home, but into rural regions.‚ Rural states (like Missouri and Arkansas) would thereby be able to develop economic sustainability.

IX. For Sustainable Economic Development: Infrastructure development and Structuring Corporations as Cooperatives

While the above reforms are critical for rejuvenating US semiconductor industry in short term, it is very critical in the long term to keep this model sustainable. This includes investment in infrastructure like high speed railways, alternative fuels, developing a comprehensive and balanced mix of broadband infrastructure expansion and effective outreach to local communities to stimulate local economic demand, promote digital economy and educate the disadvantaged and disenfranchised populations to contribute towards the greater national economy [20]. ‚ However, our most novel proposal for sustainable economic development is just round the corner.

‚

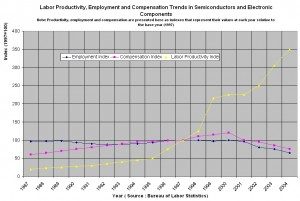

Figure 2: Labor Productivity, Employment and Compensation Trends in Semiconductors and Electronic Components [32].

‚

Figure 2 above shows a documented trend in US semiconductor industry as a result of Globalization. It can be observed that the productivity of American workforce has been consistently increasing year after year since 1987 to 2004. During this time, the advances in transistor technological nodes and new technologies might have created new jobs in US keeping the employment index relatively stable from 1987 to 2000. However, since 2000 we are seeing that the employment in US is falling instead of rising. If Globalization was supposed to increase market share of US MNCs and create more jobs, we should have observed that employment index to catch up with worker productivity. In fact, even employment compensation has been decreasing along with decreasing jobs. This shows that employees in US semiconductor industry are working harder, longer work hours and facing falling incomes and job losses despite ever increasing productivity. This gap in wages and productivity is also at the root of poor consumer purchasing capacity and recessions in the hi-tech job market. [13]

So here is our novel concept to empower the company employees.‚ By implementing Mass Capitalism[20] and enabling employees to become the primary share holders in US companies (instead of the Wall Street stock holders), the CEOs of companies would have to make decision jointly with the employee representatives on the Management Board‚ in best interest of their employees and hence of the companies. ‚ Thus, the hard work of employees would bring higher incomes through profit sharing. This kind of a co-operative economic system based on Mass Capitalism would preserve incentive to growth, and avoid undue pressure from investors on Wall Street to ship jobs overseas for getting higher return on investments [18]. Indeed, greed-motivated Wall Street Stock Exchange has been one of the prime reasons for US Economic disaster due to the hijacking of US Democracy by corporations (leading to Corporate Democracy instead of People¢‚¬„¢s Cooperative Democracy).

Above all, this policy of Cooperatively Managed Corporations (CMCs) would ensure prosperity to all Americans with a sustainable economic demand and minimize malpractices which lead to economic bubbles with a minimal government interference. This policy would also ensure that wages of hard working Americans catch up with their productivity in Figure 2, thereby regenerating consumer demand, eliminating budget deficits and paving way for balanced economy. [13]

Moving further, if the employees were to become the share-holders and joint owners of companies, the working Americans would in turn become the share-holders of the US Economy.‚ In other words, if the majority staff of company owns the majority of their company assets, then the majority of Americans would own the majority of American Economy, thereby providing the solution to the ¢‚¬Å“99:1 Issue¢‚¬ of the Wall Street movement.

The American Dream at Work: The Employee Stock Ownership Plan (ESOP)

Most private U.S. companies operating as an ESOP are structured as S corporation ESOPs (S ESOPs). The United States Congress established S ESOPs in 1998, to encourage and expand retirement savings by giving millions more American workers the opportunity to have equity in the companies where they work.

These S ESOPs provide retirement security, job stability and worker retention, due to the productivity gains associated with employee-ownership. Study shows that S ESOP companies performed better in 2008 compared to non-S ESOP firms and also paid their workers higher wages on average than other firms in the same industries. These ESOPs also contributed more to their workers¢‚¬„¢ retirement security and also hired workers when their non S-ESOP employers were cutting jobs during 2008 recession [21]. Scholars estimate that annual contributions to employees of S ESOPs total around $14 billion [22]. The net U.S. economic benefit from S ESOP savings, job stability and productivity has been estimated to total $33 billion per year [22].

A study conducted by the National Center for Employee Ownership found that S ESOP account balances were three to five times higher on average than 401(k) plans. While median employee account balances for S ESOP accounts were around 75,000 to $100,000, median account balances for employees in 401(k) plans ranged from $20,000 to $22,000 [23].

A study released in July 2012 found that S corporations with private employee stock ownership plans added jobs over the last decade more quickly than the overall private sector [24]. Alex Brill, author of the study and a former advisor to the Simpson-Bowles bipartisan deficit reduction commission, concluded that “The unique strengths of employee ownership drove company gains and jobs in the past decade, while helping insulate S-ESOP businesses from the adverse effects of the recent recession.” Brill found that members of Employee-Owned S Corporations of America increased employment by 60 percent over the past decade, versus flat employment in the economy as a whole [25].

ESOP Advantages to Employees, Productivity and Economic Growth

In a U.S. ESOP, employees do not pay taxes on the contributions until they receive a distribution from the plan when they leave the company. They can roll the amount over into an IRA. There is no requirement for private sector employer to provide retirement savings plans for employees as workers make higher wage through better job performance keeping up the incentive to work harder.

The key variable in making Employee Joint-ownership of corporations work is a high degree of involvement of employees in work-level decisions. Employee stock ownership can increase the employees’ financial risk if the company does poorly, but the data from ESOPs in the U.S. show that ESOP participants have three times the total retirement assets (including 401(k) plans) as comparable employees in non-ESOP companies [27].

Studies in Massachusetts, Ohio, and Washington States show that, on average, employees participating in the main form of employee ownership have considerably more in retirement assets than comparable employees in non-ESOP firms. The most comprehensive of the studies, a report on all ESOP firms in Washington State, found that the retirement assets were about three times as great, and the diversified portion of employee retirement plans was about the same as the total retirement assets of comparable employees in equivalent non-ESOP firms. Wages in ESOP firms were also 5 per cent to 12 per cent higher. National data from Joseph Blasi and Douglas Kruse at Rutgers shows that ESOP companies are more successful than comparable firms and, perhaps as a result, were more likely to offer additional diversified retirement plans alongside their ESOPs. The data is also available at www.nceo.org [27].

Thus ESOP and Employee joint-ownership of corporations and businesses appears to increase production and profitability, and improve employees’ dedication and sense of ownership [26] increase production and profitability and foster economic growth! Let us close with this overarching benefit of ESOP in Corporate Cooperatives!

References:

[1] Atkinson, Robert. July 2004. ¢‚¬Å“Meeting the Offshoring Challenge,¢‚¬ Progressive Policy Institute.

[2] Bardhan, Ashok and Cynthia A. Kroll. Fall 2003. ¢‚¬Å“The New Wave of Outsourcing,¢‚¬ FisherCenter for Real Estate and Urban Economics, University of California ¢‚¬œBerkeley.

[3] Bivens, L. Josh. 2 August 2005. ¢‚¬Å“Truth and Consequences of Offshoring: Recent Studies Overstate the Benefits and Ignore the Costs to American Workers,¢‚¬ Economic Policy Institute Briefing Paper#155..

[4] Blinder, Alan. 6 May 2007. ¢‚¬Å“Free Trade¢‚¬„¢s Great, but Offshoring Rattles Me,¢‚¬ Washington Post.

[5] Deitz, Richard. Winter 2004. ¢‚¬Å“Restructuring in the Manufacturing Workforce:New YorkState and the Nation,¢‚¬ The Regional Economy of Upstate New York, Buffalo Branch, Federal Reserve Bank of New York.

[6] Government Accountability Office. September 2004. ¢‚¬Å“International Trade: Current Government Data Provide Limited Insight into Offshoring of Services¢‚¬.

[7] Hira Ron. 28 March 2007. ¢‚¬Å“Offshoring America¢‚¬„¢s Technology and Knowledge Jobs,¢‚¬ Economic Policy Institute Briefing Paper # 187.

[8] Jorgenson, Dale W. 2005. ¢‚¬Å“Moore ¢‚¬Ëœs Law and the Emergence of the New Economy,¢‚¬ Semiconductor Industry Association, 2005 Annual Report.

[9] Roberts, Paul Craig. 2005. ¢‚¬Å“A Greater Threat than Terrorism: Outsourcing the American Economy,¢‚¬ http://www.informationclearinghouse.info/article25250.htm

[10] New York State Department of Labor and EmpireState Development. September 2010. ¢‚¬Å“The Offshore Outsourcing of Information Technology Jobs in New YorkState ¢‚¬œ A report to David A. Paterson, Governor and the legislature of the state of New York¢‚¬.

[11] Greg Galdabini, April 18, 2010. ¢‚¬Å“U.S. Manufacturing: The World¢‚¬„¢s Third Largest Economy¢‚¬, http://www.informationclearinghouse.info/article25250.htm

[12] Donna Ghelfi, 24 October 2005. ¢‚¬Å“The Outsourcing Offshore Conundrum: An Intellectual Property Perspective¢‚¬, http://www.ipo.org/AM/Template.cfm?Section=Copyright&Template=/CM/ContentDisplay.cfm&ContentID=17827

[13] Apek Mulay, 1 March 2013. Semiwiki – ¢‚¬Å“A Failure Analysis of the US Economy¢‚¬, http://www.semiwiki.com/forum/content/2097-failure-analysis-us-economy.html

[14] Dhanjoo N Ghista, Aug 2004. Socio-Economic Democracy and the World Government: Collective Capitalism, Depovertization, Human Rights, Template for Sustainable Peace.

[15] Jon D. Samuels, 1 April 2012. ¢‚¬Å“Semiconductors and US economic growth¢‚¬, Department of Economics John Hopkins University and IQSSHarvardUniversity.

[16] Government Accountability Office, September 2006. ¢‚¬Å“U.S. Semiconductor and Software Industries increasingly produce in China and India¢‚¬.

[17] David G. Meeker and Jay P. Mortensen, 2004. ¢‚¬Å“Outsourcing to China- A case study revisited seven years later¢‚¬.

[18] P.R.Sarkar, 1959. ¢‚¬Å“PROUT in a Nutshell¢‚¬ Parts 9-12. AMPS.

[19] Apek Mulay, May 2013 ¢‚¬Mitigation of Counterfeit Electronics through Macro-economic Policies¢‚¬,Pgs.45-47 Electronic Device Failure Analysis Magazine (Volume 15 Issue 2).

[20] P R Sarkar ,Proutist Economics: Discourses on Economic Liberation, by (ISBN81-7252-0034), Ananda Marga Publications, EM Bypass, Tiljala, Culcatta-39, 1992.

[21] Philllip Swagel and Robert Carroll, 10 March 2010.”Resilience and Retirement Security: Performance of S ESOP Firms in the Recession.¢‚¬

[22] Steven F. Freeman and Michael Knoll. 29 July 2008. “S Corp ESOP Legislation Benefits and Costs: Public Policy and Tax Analysis.¢‚¬

[23] Rosen, Corey – The NationalCenter for Employee Ownership. September 2005.

¢‚¬Å“Retirement Security and Wealth Accumulation in S ESOP Companies.¢‚¬

[24] Alex Brill, 26 July 2012.”S Corporations Lead Way on Jobs, Report Says¢‚¬.

[25] Loren Rodgers, 1 Aug 2012. “The Employee Ownership Update ¢‚¬œ New Report Shows that ESOP Companies Generate More Jobs.¢‚¬

[26] J. Blais, R. Freeman, D. Kruse (2010), Shared Capitalism and Work However, NBER Publications.

[27] NationalCenter for Employee Ownership, 2010, Research on Employee Ownership, Corporate Performance, and Employee Compensation, NCEO web site (www.nceo.org)

[28] Martin Staubus, RadySchool of Management UC San Diego, Sustaining Employee Ownership for the Long Term: The Challenge of the Mature ESOP Company. http://rady.ucsd.edu/beyster/media/newsletter/2011/fall/longterm-eo.html

[29] James Burke, Seung- Yun Oh & Gerald Epstein, February 2011, Outsourcing, Demand and Employment -Loss in U.S. Manufacturing, 1990 ¢‚¬œ 2005.

[30] Lael Brainard and Robert E. Litan, April 2004, “Offshoring” Service Jobs: Bane or Boon and What to Do?

[31] Dr. Dhanjoo N. Ghista, 19 March 2012. Ozark Rural University, West Plains Daily, Howell County, Mo.

[32]United States Government Accountability office Report to Congressional Committees, September 2006, ¢‚¬Å“Offshoring: US Semiconductor and Software Industries increasingly produce in China and India¢‚¬

‚

About the Authors

[1] Apek Mulay is a Senior Failure Analyst at Microtech Analytical Laboratories in Plano, TX. His professional background includes electronic engineering, semiconductor processing and device physics, semiconductor failure Analysis and economic policy analysis. He has worked as a Failure Analysis Engineer in US corporations like Qualcomm Inc. and Texas Instruments Inc. Prior to joining Microtech, Apek was working on 28nm technology development in Advanced CMOS technology development team at Texas Instruments Inc. Apek has a registered US patent on ¢‚¬Å“Surface Imaging with Materials Identified by Colors¢‚¬, while employed at Texas Instruments Inc. He has been actively involved in International Symposium for Testing and Failure Analysis (ISTFA) by chairing technical sessions at symposium. He is also a contributor to the International journal EDFAS. In recent years he has been active in publishing papers on US economy, trade deficit and budget deficit.

[2] Prof Dr. Dhanjoo Ghista is a world authority in biomedical engineering and physics, and promoter of the role of governance competency for effecting sustainable economic development and the role of university in progressive societal development. He is the author or editor of several textbooks in subjects ranging from biomedical engineering mechanics to economic democracy and from cardiovascular physics to African Rural Development; He is the inventor of heart valvular prostheses and has innovated a novel STEM model of Medicine.‚ His work as the founder and leading exponent of the new science of societal engineering has received recognition in academia.

After getting his PhD at StanfordUniversity, he started his professional career at NASA where he worked in Aerospace engineering and medicine.‚ Thereafter he has had developed a sterling record of institutional developments at universities, having set up new programs, departments and colleges; he has also been involved in restructuring of universities and in the planning of new universities.

Along with having being editor-in-chief of Automedica (an international journal of high-tech medicine) and Renaissance Universal, Prof.‚ Ghista has published over 450 works in the fields of engineering science, biomedical engineering, medical science, and social sciences. He has also published 29 books on biomedical engineering, engineering physiology, cardiovascular physics, orthopedic mechanics, medical and life physics, spinal injury biomedical engineering, socio-economic democracy and world government, and African development.

He is a pioneer in the fields of biomedical engineering and physics, healthcare engineering and management, governance and economy, and urban-rural economically sustainable communities. He is launching the Rural Universities for Rural Development movement, and the University 2020 movement to promote comprehensive universities having a cooperative engagement with their communities.

He is the propounder of the American Dream Economics, by which the average Americans can realize their dream of getting affordable topmost education and well-paying jobs, of owning their homes and getting cost-effective healthcare, and have the satisfaction of contributing to domestic consumer demand and to the economic sustainability of their communities.

He is a proponent of Neohumanism, and is committed to the advancement of rural communities and Developing countries. His detail biography can be found at http://dhanjooghista.googlepages.com

Recent Comments