This has been originally published on EBN

Macroeconomics plays a critical role in operation of any business as prevailing economic conditions affect individual businesses as well. Entrepreneurs and others business people must take these factors into consideration as part of their market analysis.

As one example, the reduction or increase in demand for products affects decisions to expand or scale down their rate of production. Macroeconomics is intertwined with business because business is affected by the factors that constitute macroeconomics. Macroeconomics deals with issues relating to factors that affect the economy, including areas like the rate of unemployment, inflation, business cycles and Gross Domestic Product (GDP).

In this blog, I will explain the role of macroeconomic cycles and how it relates to business models prevalent in semiconductor industry. The semiconductor industry in United States has undergone transformation from a few integrated device manufacturers (IDMs) to several fabless companies. The fabless-foundry business model has led to transformation of US semiconductor industry.

However, the fabless-foundry business model violated common sense macroeconomic parameters, and the macroeconomic losses to US economy began to outweigh the microeconomic benefits from the approach. The US semiconductor industry began offshoring labor-intensive manufacturing operations in the 1960s, followed in the 1970s and 1980s by increased offshoring of complex operations, including wafer fabrication and some research and development (R&D) and design work. Although offshoring of labor-intensive semiconductor jobs from US to Japan had started way back in 1960s, the macroeconomic losses then were minimal due to prevalent free market capitalism in US.

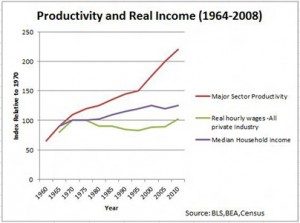

When Federal Election Campaign Act (FECA) was passed in 1971, the resulting political corruption through unlimited contributions of “soft money” transformed free market capitalism to crony capitalism. The budget deficits started to soar when huge tax cuts were passed under president Ronald Reagan’s presidency. The graph below shows that since the FECA was passed in 1971, the monetary policy started to change due to political corruption so that real wages of employees started to trail employee productivity.

Figure 2: BLS, BEA Census- Productivity and real income index from 1964-2008 relative to 1970 (Source: David Ruccio: Graph of the week: USA productivity and real hourly wages 1964-2008

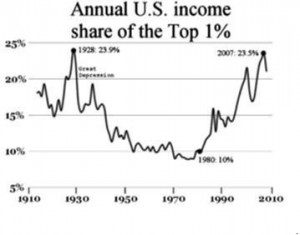

This monetary policy resulted into increasing gap between wages and productivity. The tax cuts passed by President Reagan resulted in growing disparity in United States. The graph below shows a comparison between the great depression and great recession since 2007 as a result of growing economic disparity, showing clear evidence that a great depression has actually started in United States in 2008. The disparity started to grow in 1980 and when the economic disparity reached close to what it was just before 1929 great depression, stock markets crashed in 2008.

Macroeconomic Cycles & Economic Forecasts

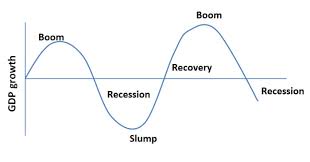

Let us analyze the macroeconomic cycles that resulted into the great recession of 2007. Everything governed by laws of nature moves in a systaltic fashion and never in a straight line. Due to this systaltic motion, internal clash and cohesion take places giving rise of economic cycles. The ups and downs of socio-economic life in different phases are sure to take place due to this systaltic principle.

These macroeconomic cycles generally last seven to 14 years. Especially when the common sense macroeconomic parameters are grossly violated, the macroeconomic cycle shifts to the shorter period and in seventh year of the cycle, the economy starts losing its momentum. Since the tax cuts in 1980, budget deficits started to soar and trade deficits were already increasing as a result of free trade policies. In fact, fabless-foundry model resulted in increased offshoring of even the capital-intensive jobs along with ongoing offshoring labor-intensive jobs from United States.

The macroeconomic parameters that were violated since 1980 translated into an increasing gap between wages and productivity. The US has sustained these deficits by failing to fix the root cause of problem (i.e. the growing gap between wages and productivity) but instead by printing US dollars. Now, let us look at the evidence of macroeconomic cycles post Reagan’s tax cuts in 1980s.

1.In finance, Black Monday refers to Monday, October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time. This occurred seven years after 1980.

2.1994 wasn’t a particularly notable year. There was no presidential election, no major geopolitical developments, no stock market crash, and no summer Olympics. However, in 1994, the bond market suffered a very sharp and sudden sell off that started in the U.S. and Japan and then spread more or less across all developed markets. This was seven years after 1987 crash.

3.On September 17, 2001, U.S. stocks plunged to the lowest levels in nearly three years, and the Dow Jones industrial average suffered its worst point-loss in history when trading resumed for the first time following September 11, 2001 terrorist attacks. This was seven years after 1994.

4.According to ex-Fed chair Ben Bernanke, September and October of 2008 was the worst financial crisis in global history, including the Great Depression. This occurred seven years after 2001 crash.

As we can see, the macroeconomic cycles of seven years have never been violated since the 1980s. Recently, Alan Greenspan acknowledged that the economic demand today is as weak as it was during the great depression, which concludes what I presented in the graph comparing economy with the Great Depression. Based on these macroeconomic cycles, I believe that it is a near certainty that seven years after 2008, which is 2015, there will be a crash of US stock market.

My forecast is that starting July 2015, stock markets across the world will begin to fall and by October 2015 we will have an event like the Black Monday of 1987. As I have explained, since 1980s the way US has been solving its macroeconomic problems is not by means of fixing its monetary policy to bring back free markets to keep wages on track with productivity. The real fixes to our economic problems are being delayed by excessive monetary printing. Hence, the coming economic crash of 2015 will most likely be a complete collapse of crony capitalism. No matter how much the Fed delays its hiking bench mark interest rates, the macroeconomic cycles cannot be controlled by central banks.

The role of macroeconomics in operation of businesses can be seen in way the condition of the economy affects individual businesses. For instance, during a recession, the behavior of customers and consumers of goods and services change to reflect the change in the economy.

Such changes can be seen in the way the demand for goods and services drop and the manner in which such a reduction affects the balance sheets of the various businesses. How should then the business model be for the semiconductor industry to ensure that it complies with these macroeconomic cycles of nature, which are beyond the control of any human being, corporation, or nation? This, dear readers, is the topic for my next blog.

Recent Comments