This has been originally published on EBN

The government of India has approved setting up two semiconductor wafer fabrication (FAB) manufacturing facilities in India. These FAB units are to be set up by two business consortia, one led by Jaiprakash Associates Limited with IBM USA as technology partner [Technology: 90/65/45/28 nm, Capacity: 40,000 WSPM] and other led by HSMC Technologies India Pvt. Ltd with ST Microelectronics as technology partner [Technology: 90/65/45/28/22 nm, Capacity: 40,000 WSPM].

The government of India will extend several incentives to the two consortia:

•25% subsidy on capital expenditure and tax reimbursement as admissible under Modified Special Incentive Package Scheme (M-SIPS) Policy.

•Exemption of Basic Customs Duty (BCD) for non-covered capital items.

•200% deduction on expenditure on R&D as admissible under Section 35 (2AB) of the Income Tax (IT) Act.

•Investment linked deductions under Section 35AD of the IT Act.

•Interest free loan of approx. Rs. 5124 crore each. (Exact amount to be calculated on appraisal of Detailed Project Report)

In my recently published article, I made a case that one way for India to reduce its current account deficits from its imported electronics is by attracting inflow of foreign capital into India. This would compensate for any flight of foreign capital since the end of Quantitative Easing (QE) policies of Fed.

Since the financial crisis of 2008, countries like India have been prime beneficiaries of Quantitative Easing (QE) policies of the US Federal reserve. The investors borrowed cheap short-term money in the US and invested in higher yielding assets in India. The massive capital inflows also let India comfortably finance its trade and current account deficits. However, now that QE has come to an end in the US, the capital inflows into India will start moving out putting pressure on Indian rupee in coming years. In India, the Reserve Bank has been intervening in support of the struggling rupee in recent sessions, triggered by a worsening trade deficit.

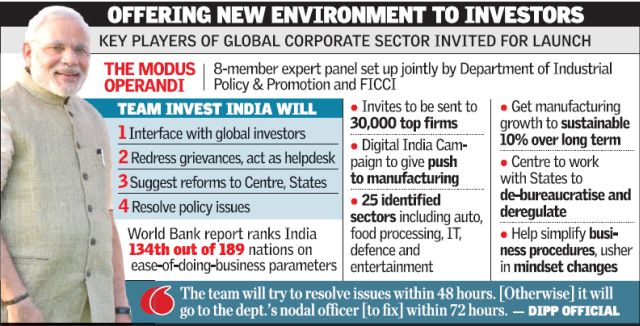

As part of its Make in India initiative, India wants to become a global semiconductor manufacturing hub like China. In an attempt to build India’s industrial base nationwide, prime minister Narendra Modi is pushing the Make in India campaign, designed to attract foreign investment by highlighting the ongoing changes. “We have to increase manufacturing and ensure that the benefits reach the youth of our nation,” Modi tweeted after the initiative’s Sept. 25 introduction. With this vision in mind, the prime minister of India, Narendra Modi has also invited US president Barack Obama as a chief guest on the occasion of India’s 66th republic day celebrations on January 26, 2015.

Make in India in high-tech semiconductor manufacturing is certainly important step taken by India to minimize India’s current account deficits because of large quantity of imported electronics due to its burgeoning middle class. However, without significant macroeconomic reforms, Make in India will not be able to solve its intended goal of reducing India’s current account deficits. Let us analyze the problem before we look into proposed solutions for success of Make in India.

First, from a macroeconomic perspective, there are two components to an account deficit viz. trade and budget deficits. India’s free trade policies have made a major contribution to India’s trade deficit over the years. As a result of free trade, not only India has lost its major manufacturing industries to China but it has led to an entry to foreign manufactured goods into the country without having to pay any import duty including imported consumer electronics. If India wishes to ensure that Make in India becomes a success for high tech semiconductor manufacturing, it will have to replace its free trade policies by means of fair trade policies to ensure that domestic manufacturing can withstand foreign competition.

In addition, India should also make a note of the fact that US central bank is on track to raise interest rates in 2015, which will force the federal government to reform its monetary policies so that wages keep track with productivity to avoid an economic, crash. The US will not be able to run any trade deficits after Fed starts to hike its interest rates. As a first step, the US has already announced huge tariffs on solar goods imported from China and Taiwan. US-based MNCs will not be able to offshore manufacturing jobs to low labor cost countries (LLCs) and import these goods into the United States without having to pay any import duty to reduce US trade deficits.

Hence, India should not depend on US based MNCs to offshore their manufacturing to India due to macroeconomic changes coming to US economy. Just like US has been backshoring manufacturing from LLCs to US to reduce its trade deficits, India should also plan on making Make in India successful by ensuring robust domestic demand for a sustainable manufacturing. Therefore, even though the hourly labor costs in India for manufacturing averages 92¢ as compared with $3.52 in China (according to Boston Consulting Group), US will not be able to sustain its trade deficits any longer by means of offshoring manufacturing to LLCs like India in order to retain value of US dollar.

With regards to India’s burgeoning budget deficits, these deficits are a result of monetary policies followed by India’s central bank, which results into growing disparity in India. Just like Fed, the Reserve Bank of India (RBI) also follows monetary policies such that real wages trail employee productivity. When Indian government offers huge tax incentives to the two consortia for establishment of High Tech semiconductor manufacturing facilities in India and does not reform the monetary policies of its central bank, the net result of these policies will be an addition to India’s burgeoning budget deficits.

The US has been able to sustain its twin deficits by printing its currency but the coming macroeconomic changes in US will force Fed to follow a monetary policy that ensures that wages keep pace with productivity. Unlike the US, India cannot sustain its deficits by printing currency, as India is not a global trade currency. Such policies have been responsible for rising inflation in recent past. Once wages catch up with productivity in India, the balanced economy will ensure a minimal intervention by RBI when an increased domestic consumer demand will call for its own supply of goods.

If these common sense macroeconomic reforms are not implemented by authorities involved in making the semiconductor wafer manufacturing facilities (FABs) a success for Indian economy, the budget deficits will start to soar from huge tax breaks given to the consortia. Additionally, India’s trade deficits will also soar from the import of duty free consumer electronics due to its free trade policies. These twin deficits will be massive due to growing middle class and would cause a disastrous failure of Make in India for high-tech semiconductor manufacturing. The present plan will not be able to achieve its goal of eliminating India’s projected current account deficits of $400 billion (from imported electronics) by year 2020. Only a balanced economy can help India make its huge investments sustainable so that the semiconductor manufacturing facilities will be able to cater to a robust domestic consumer demand.

Recently, the US announced huge tariffs on solar goods from China and Taiwan as a first step to boosts its domestic manufacturing. Eventually, US will have to impose tariffs on all foreign manufactured goods entering the US in order to boost domestic manufacturing that eliminates its trade deficits. In that regard, Indian manufactured goods will be not able to compete in US just because of its low cost of manufacturing when an import duty is imposed from fair trade policies. Hence, India needs to ensure that it has a robust domestic demand for electronic goods so that the semiconductor wafer fabs remain in operation 24×7 to minimize any idle time of fabs.

The solution to this macroeconomic crisis is to reform RBI’s monetary policies to usher in a competitive free market economy so that wages keep track with employee productivity to eliminate budget deficits. Additionally, by ensuring that wages keep track with productivity, a robust consumer demand can be ensured through growth in real wages as compared to unsustainable demand through growth in consumer debt.

The trade deficits have to be eliminated by reforming free trade policies by fair trade policies. In this way, by means of establishing a fabless semiconductor eco-system based on a three tier business model would lead to balanced economic growth and sustainable semiconductor manufacturing ecosystem for India.

Recent Comments