While the Modi government has won its elections making promises to bring back black money of Indians stashed abroad, the policies of this government is in fact creating more black money domestically. Forget about the promises of putting Rs.15 lacs in every Indian’s bank account, Indians should be careful about losing money from their bank accounts with the present government policies. Before we understand how Modi government is creating more black money domestically, let us understand how Black money is created in first place.

In my first volume MASS CAPITALISM, I had authored a chapter on revamp of financial industry, where I also proposed a solution to eliminate black money in the economy. Black money is the unaccounted money which creates a parallel economy in country. Here was my proposal-

“In order to avoid the accumulation of black money in domestic economy because of evasion on income taxes, the existing tax structure should undergo following common sense reforms. All taxes should be levied at starting point of production instead of giving tax cuts to the corporations. This would increase collection of tax revenue from corporations and reduce tax burden on consumers . These taxes on corporations should be levied such that all essential commodities should be tax free and by means of levying 10% excise taxes on luxury goods and other excisable commodities, there would be no net loss in revenue collected by government. This way income tax on citizens could be minimized to boost their consumer purchasing power. When there are low income taxes on all, nobody would try to accumulate black money. In this way as black money would be eliminated from domestic economy, all money would be white money. White money would result in less hoarding and increased circulation of money in domestic economy which would result in rise in value of domestic currency as a result of its circulation. This would further drive economic growth and have a multiplier effect on domestic economy.”

I have already presented these ideas at BJP think tank in Mumbai in December 2014 and they have not only endorsed these common sense ideas but they are in fact creating more black money with their policies since 2015. To understand this, we need to understand how are tax rates going to change on corporations and how much are tax rates going to increase on consumers.

1. Corporate Taxes – Finance minister Arun Jaitley had in his budget speech (February 2015) said the government would reduce corporate tax rate to 25% over the next four years from the present 30%. But this would be accompanied by a corresponding phase-out of tax exemptions and deductions, which would bring more clarity to the tax regime.

Analysis– The reduction in corporate taxes to 25% from 30%, would result in a deficit in the government. While the corporations are experts in evading taxes even when the rates are 25%, the burden of tax evasion falls on the government budget and which finally falls on tax payers of country. With less than 5% of Indians paying taxes, the taxes on Indians will have to go up to pay for the deficit in government resulting from giving tax cuts to corporations.

2. GST Taxes – Though the rate of GST is yet to be finalized, the same is expected to be higher than the present effective rate on services of 14.5%. There could be a temptation to further increase the effective service tax rate to say 16.5%. If that turns out to be the case, then it is going to pinch every consumer as they will have to pay more for eating out at restaurants, hotel stay, phone bills, broadband connections, air tickets etc.

Analysis- The problem with GST is that it makes services expensive for the consumer. This rise in taxes on consumer has to be compensated by the government by means of being able to raise the buying power of the consumer through higher wages for consumers. However, The taxes on consumers are rising and the real wages are not rising in the economy except for government employees…who have been promised a net pay increase of $13 billion without any accountability of their productivity. The rise in wages have to be tied with rising productivity else it results in drop in labor force participation rate in an economy. There will be a deficit created of $13 Billion if the government does not force government employees to become more productive by means of use of technology. It will be a matter of time for us to see how rising income without rising productivity results in an economic imbalance like Romania.

In a book review for MASS CAPITALISM by an economist from Romania,Magdalena-Maria GROSU writes-

“It is noticeable that, in Romania, after 1990 there are years in which the dynamics of real wage was higher than dynamics of labour productivity, infringing on the basic relation between wage and productivity.

In Romania, wage, reward of the work carried out, the least liberalized price in the transition period, in some cases it has been underrated and in some cases it has been overrated in relation to performances achieved, for certain occupational categories.

The number of employees after 1990 almost halved (from 8 000 thousand to 5000 thousand employees, 2013), and economic and social effects of this trend accumulate in the area of financing capability of some key public services to support the sustainable economic growth, such as research-development, education, health and social assistance, defense and peace etc. All these affect the equilibrium of labour market, and the other markets as well, more precisely macroeconomic equilibrium and sustainable development.”

3. KKC Tax, Swacch Bharat Tax, etc. – If you observe since the Modi government has come to power, all Indians from the rich to the poor have seen a steady burden of indirect taxes such as Krish Kalyan Tax, Swachh Bharat Tax, etc. to pay on every services that they opt for.

Analysis – All these taxes hurt the middle class and poor and only way to avoid such indirect taxes by consumers is by having a transaction in cash. The government is forced to raise these indirect taxes (in the name of development) but the actual reason is the deficit that will be created due to cut in corporate tax rates from 30% to 25%.

All these direct tax cuts to the corporations (in the name of business friendly government) and rising indirect taxes on consumers (in name of development), contributes to increasing black money in an economy. Forget about the fact that Modi government has been giving multiple deadlines for declaration of black money held abroad and when will that come back into India is truly questionable. The least the government can do is stop creation of more black money domestically through its policies.

I would like to remind the government that as an entrepreneur, I would like consumers to have higher consumer purchasing power so that they can buy more products from my e-commerce business. Where will the consumer get that high purchasing power if s/he is burdened with such rising indirect taxes? Hence, Modi government’s policies are turning to be anti-consumer and hence anti-small business, anti-entrepreneurship and pro-big business.

The association of big business and government is a text book case of crony capitalism elaborated in my volume MASS CAPITALISM. What India needs is FREE MARKET CAPITALISM not another dose of crony capitalism from Modi government. It is possible to achieve low income taxes on consumers to stimulate economic demand as well as to achieve free markets by connecting the rising wages to rising productivity of workforce. However, I find it ridiculous that government does not want to endorse these common sense macroeconomic policies but wants to deceive Indians with their steady burden to higher indirect taxes on consumers to give tax cuts to big businesses.

And, It is no wonder that Government’s focus is on MAKE IN INDIA by suppressing wages of Indian workers as compared to MAKE FOR INDIA by rising wages of Indian workers in proportion to their rising productivity. MAKE IN INDIA policies are most dangerous thing and I have already elaborated the dangers of such policies in China and Ireland in my article

Make In India Could Collapse Indian Economy

About the Author-

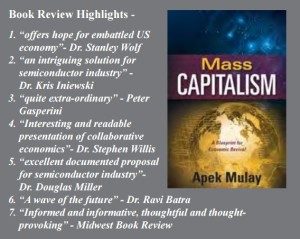

Apek Mulay is author of books Mass Capitalism: A Blueprint for Economic Revival, Sustaining Moore’s Law: Uncertainty leading to a Certainty of IoT Revolution. Mr. Mulay is authoring his third volume with Business Expert Press entitled How the Information Revolution remade Business, and the Economy: A Roadmap for Progress of the Semiconductor Industry with More-than-Moore and Beyond Moore. He is also an investing partner in an e-commerce business Calcuttahandicraft.in which he started to envision his ideas about Mass Capitalism.

www.ApekMulay.com.

Recent Comments