On Black Monday , 24th August 2015, I was invited by a local Television station “Mi Marathi” in India to give my opinion about Black Monday where my forecasts made in March 2015 have started to come true. You can watch the entire 17 minutes of my interview focusing on the India’s budget 2015 where I forecasted on 15 March 2015 about coming Global Financial Crisis by end of 2015. I mentioned that this crisis will start from developing countries before it would strike the United States of America.

As I mentioned in my interview on Black Monday, India has potential but its “Make in India” policies are headed in wrong direction leading to a failure just like “Make in Ireland” and “Make in China”. I also mentioned that the prime reason for collapse of Chinese economy was absence of common sense in the macroeconomic planning resulting in an economy focused more on exports and ignored the consumer purchasing power of domestic residents.

Hence, When the developed economies in US and Europe started to slowdown, China also started to slowdown and ultimately, its economy crashed. Hence, The chief engine of Economic growth in any country is the purchasing power of its domestic citizens which drives the economic demand. How to make that happen through free market economic reforms and many other significant reforms has been presented as a blueprint in my first book ‘Mass Capitalism : A Blueprint for Economic Revival’. The book trailer is below.

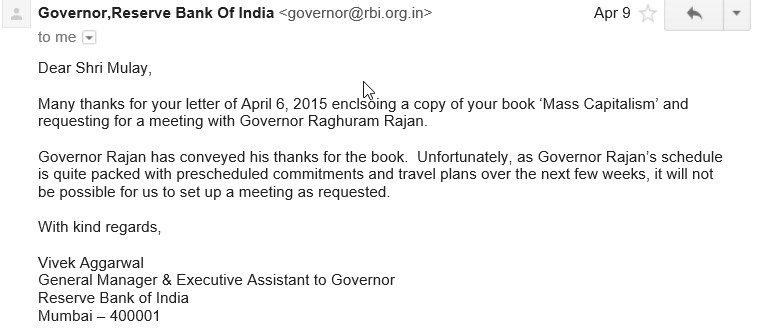

As I was aware about an impending Global Financial Crisis in 2015 which would be far severe than 2008, I also sent an autographed copy of my book to RBI’s governor, Dr. Raghuram Rajan and his office acknowledged the receipt of my book as well below.

In a recent interview with Steve Liesman, CNBC Senior Economics Reporter, Dr. Raghuram Rajan said that Fed should not hike interest rates in this turmoil. He also said, “[A strong dollar] does cause some fragility, but on the other hand if it’s accompanied by very strong U.S. growth it does help other countries who can then export to the United States and pick up their own economies on that basis”. Dr. Rajan said that he hoped to find a Magic Bullet of Economic growth but he did not rule out cutting rates in India for a fourth time, admitting that the world’s central problem is continued slowing economic growth.

I would disagree with Dr. Rajan that cutting interest rates is a remedy and would bring about a growth in India’s economy. The very fact that Dr. Rajan is still looking for a Magic Bullet tells me that even after providing him my book alongwith a letter about my ideas for helping in “Make in India”, Dr. Rajan has most likely not read my book and hence he is still searching for a Magic Bullet for growth.

Not only does United States need to focus on increasing purchasing power of its domestic residents in order to bring back economic growth, India should also implement free market economic reforms based on Mass Capitalism in order to boost the purchasing power of its domestic citizens when it implements it “Make in India” initiative. Unless, the domestic economy is robust, a country’s economy, no matter how strong, is not immune to external shocks. This has become evident from the recent Collapse of China’s stock markets.

I mentioned this in my April 2015 Interview on India’s National News (India’s version of Public Broadcasting Station) about ‘MAKE IN INDIA’ to focus on domestic economy first before focusing on exports . This has been re-echoed especially given the Collapse of Chinese Stock markets due to ignorance of their domestic Economy. Hence, I could envision a better macroeconomic policy for ‘Make In India’ by learning from mistakes committed by other countries.

Another world renowned economist, Professor Ravi Batra has cited ‘Mass Capitalism’ in his recent book “End Unemployment Now: How to Eliminate Poverty, Debt and Joblessness Despite Congress” calling it ‘A Wave of the Future’. Hence, Unless India as well as United States do not undertake free market economic reforms based on MASS CAPITALISM so that real consumer purchasing power of domestic residents grow, there is no hope for any economic growth in either country.

By just lowering its repo rates, RBI’s governor is helping businesses in India by creating a debt based economy. Given the collapse of housing bubble in United States in 2008, RBI’s governor should not lower repo rates and preserve India as a nation of savers rather than a nation of debtors. He should undertake significant financial reforms to increase circulation of currency in economy. Some to these ideas have been explained in depth in the chapter “On National Financial Matters” of my first book “Mass Capitalism: A Blueprint for Economic Revival”.

Recent Comments