Summary/newsletter meta: Corporations that manufacture offshore and then import their own goods duty-free distort the supply chain. Economic reforms including a proposed cooperative business managerial system could repair the damage done in the name of ¢‚¬Å“free trade.¢‚¬

Keys: U.S. supply chain, outsourcing, offshore manufacturing, economic reform, free trade, cooperative business managerial system, university-industry conglomerate, opportunistic capitalism

The roots of disruption in the U.S. supply chain of electronics and semiconductor goods lie in the ¢‚¬Å“free trade¢‚¬ policies that the United States adopted after World War II. Because that war was not fought on U.S. soil, the nation sustained no damage to its manufacturing base. On the contrary, the U.S. economy benefited, climbing out of the Great Depression as U.S. citizens went to work in U.S. factories that provided munitions to European allies whose own manufacturing economies were battered. By the war¢‚¬„¢s end, the United States was the global locus of capitalism. The munitions trade with Europe during the war had allowed the United States to increase its gold reserves, and the U.S. dollar (USD) became the global trade currency [1].

U.S. multinational corporations (MNCs) seized the opportunity to increase their market share in the war-damaged countries. The MNCs leveraged their position to influence the General Agreement on Tariffs and Trade (GATT) and, later, the World Trade Organization (WTO), pushing for treaties that would advance ¢‚¬Å“free trade¢‚¬ by lowering or abolishing trade barriers between member countries, including the United States [2]. The MNCs¢‚¬„¢ aim was to secure free access to foreign markets without the imposition of import taxes. Years later, these businesses realized that if U.S. goods could be manufactured abroad in China, imported back to the United States without import duties and then sold to American consumers, the corporate profits of MNCs would increase exponentially.

This ¢‚¬Å“opportunistic capitalism¢‚¬ had microeconomic fallout, in the form of U.S. layoffs as the MNCs moved operations offshore. It also set the stage for macroeconomic disaster, as decreased exports and increased imports worsened trade imbalances and deficits and affected the market value of the USD. Normally, in a legitimate supply chain, companies domestically manufacture and market products that are supplied and distributed in their own country and abroad. By contrast, the deceitful mode of manufacturing and marketing abroad, and then bringing the manufactured products back to the United States without having to pay import duties, constitutes a distorted supply chain.

Twin deficits¢‚¬„¢ role in foreign policy

In recent decades, business leaders have sold free trade to Americans as a way for businesses to generate revenue for further investment in R&D, with reductions in production costs and increases in operational efficiency achieved abroad. This is the myth of free trade.

In the postwar years, with world economies still reeling, the U.S. MNCs had virtually no competition worldwide, and free trade thus increased the profits of U.S. MNCs while helping to revive the war-ravaged economies. As time passed, the countries devastated during World War II regained their economic footing, and growth resumed. Semiconductor manufacturing jobs were the first wave of the jobs to be outsourced to countries such as Japan during the 1960s [3].

America in the 1960s had a progressive tax structure that imposed high tax rates on the wealthy. Under President Eisenhower, a Republican, the top 1% of American earners paid a maximum tax rate of 92% [4]. Revenues from the high taxes imposed on the wealthy allowed taxes that fell on middle-class Americans, such as sales, payroll and Social Security taxes, to be kept low. Thus, the consumer purchasing capacity of the middle class was high, in turn fueling high consumer demand. Domestic demand for U.S.-manufactured semiconductor goods and services resulted in 4% year-over-year growth in GDP [5]. Based on these facts, we can observe that because of the high consumer purchasing capacity and high domestic demand for U.S.-manufactured products, the early offshoring of semiconductor manufacturing to Asia did not unduly hurt the U.S. domestic economy.

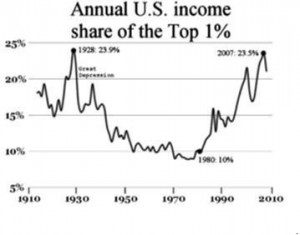

With the outsourcing of manufacturing to Japan that began in the 1960s¢‚¬and the hard work of the Japanese people¢‚¬U.S. imports of electronics ¢‚¬Å“Made in Japan¢‚¬ increased, and over time Japan¢‚¬„¢s economy grew robust. The problems started in the 1980s, as President Ronald Reagan¢‚¬acting on a promise to revive the U.S. economy, which had slowed as manufacturing shifted to Japan¢‚¬enacted huge tax cuts for the wealthy. Reagan then had to increase Social Security, sales and payroll taxes, which significantly cut into the paychecks of all Americans, but particularly the middle class. The decreased purchasing capacity of average Americans reduced domestic consumer demand for U.S. products. This was the beginning of the untouchable privileged class (¢‚¬Å“the 1%¢‚¬) and the end of confidence in the American Dream (the idea that wealth and privilege are attainable by anyone who works hard)¢‚¬culminating, in 2011, in the Occupy Wall Street movement and its slogan, ¢‚¬Å“We are the 99%,¢‚¬ which opened a dialogue on income inequality and wealth distribution in the United States [6].

As tax cuts for the wealthy and declining purchasing capacity among the middle class took their toll on federal tax revenues, the Reagan administration started running significant deficits. In 1985, the administration forced the Plaza Accord on Japan, whereby the Japanese yen appreciated significantly with respect to the USD [7]. Reagan advisers considered the move necessary to support U.S. exports to Japan and believed it would help balance the budget. The unforeseen result of the yen¢‚¬„¢s appreciation was that Japan¢‚¬„¢s economy crashed and lost a decade of growth. The Nikkei average had risen to about 39,000 in December 1989, but after the crash it hovered around 15,000 during the ¢‚¬Å“lost decade¢‚¬ of the 1990s [8]. In the last several years, it has dropped even more, hovering around 10,000.

The actions that Republicans have proudly termed Reaganomics marked the beginning of spiraling U.S. budget and trade deficits [9]. Reaganomics was an ill-conceived and defective economic policy that robbed the middle class and buffeted the wealthy.

U.S. MNCs next began outsourcing their jobs to China. As China became a manufacturing base for virtually all U.S. MNCs, the year-over-year increases in corporate profits from cheap Chinese labor became an incentive to send even more manufacturing jobs to that country and relegate the domestic employee base to service-sector jobs. The U.S. budget deficits had started with Reagan¢‚¬„¢s tax cuts for the wealthy and tax increases on the middle class. Now, cheaply manufactured Chinese goods entering the U.S. supply chain resulted in trade deficits, as the United States imported more than it exported. Thus, free trade acted as an incentive for trade deficits. If the United States had adopted fair trade instead of free trade, tariffs could have been imposed on the cheap goods dumped into this country by China. Such tariffs would have made U.S. goods competitive with Chinese products, and U.S. manufacturing jobs would have been preserved.

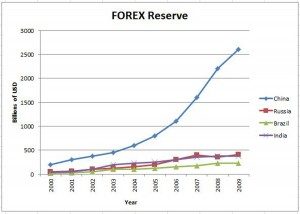

Today, the United States runs a $600 billion annual trade deficit and approximately a $400 billion annual budget deficit [10]. Because the USD is global trade currency, the United States has been able to compensate for its twin trade and budget deficits by printing its currency. As a result of the twin deficits, the foreign exchange (FOREX) reserves in USD of U.S. trading partners such as Russia and China are growing annually.

Though the trade deficit with China has resulted in higher corporate profits for U.S. MNCs that outsource manufacturing jobs to China, these policies result in depreciating FOREX reserves for the United States. This seriously threatens not only the global economic status and independence of the United States, but also its R&D and even its security. Figure 1 shows the FOREX reserves of the BRIC countries (Brazil, Russia, India and China) in USD over 10 years. According to Richard Haas, chairman of the Council of Foreign Relations, China¢‚¬„¢s ownership of trillions in FOREX USD is a great threat to the United States, as China, with its vast FOREX reserves, is in a position to influence U.S. foreign policies through its control over the value of U.S. currency [11]. This is similar to the way the United States was able to dominate the foreign policies of Britain and France after World War II; purely because of its ownership of British and French debts, it was able to force those countries¢‚¬„¢ troop withdrawal during the Suez Crisis [12].

Figure 1: World FOREX reserves in billions of USD.

Source: International Monetary Fund, April 2009 [10].

In addition to the trade deficit that has resulted from free trade policies, the counterfeit electronics entering the U.S. supply chain from China have become a national security threat. Initially, the United States manufactured all defense-related products at home, while building consumer electronics in China to capitalize on low labor costs. The progression to advanced transistor technology, however, required increasingly large investments on the part of defense contractors that manufactured semiconductor wafers in the United States. Hence, several independent and for-profit defense contractors based in China started making use of Chinese-built ICs for military weapons such as missiles and machine guns. Thus, the state-of-the-art infrastructure and technical know-how to make advanced technology products have also been transferred to China.

China is now flooding the U.S. defense supply chain with counterfeit ICs [10]. It has become very expensive to mitigate introduction of counterfeits into the U.S. supply chain, and it is cutting into the profits of U.S. defense contractors.

There is no solution for the twin budget and trade deficits under the exploitative free trade scenario. The United States cannot afford to run year-over-year budget deficits. To protect its sovereignty, it needs to reexamine its internal economic policy as well as its foreign policy. We need to restore the U.S. manufacturing supply chain so as to ensure a sustainable economy, eliminate budget and trade deficits, balance consumer demand with supply, and have the 99% own 99% of the wealth.

Macroeconomic reforms

To restore the distorted U.S. supply chain to legitimacy, the U.S. government must set beneficial corporate tax policies and provide federal tax incentives, and fair trade must replace free trade. Restoring the U.S. supply chain involves bringing back the jobs lost to outsourcing offshore.

¢‚¬Å“Backshoring¢‚¬ and ¢‚¬Å“insourcing¢‚¬ of U.S. manufacturing jobs will require appropriate incentives, such as capital grants, lower tax rates and tax holidays, to establish manufacturing bases in U.S. rural areas and make them competitive with low-labor-cost countries. Collaboration between rural universities and industries would reduce R&D costs. Cooperative-ownership corporate structures that enable employees to share in corporate profits would result in the growth of overall economy [13].

Here¢‚¬„¢s a closer look at these proposals for rejuvenating the U.S. electronics and semiconductor industry, restoring prosperity for all Americans, and preserving the American Dream incentive for hard work.

Backshoring to low-cost rural areas‚ ‚ ‚ ‚ ‚ ‚ ‚ ‚ ‚ ‚ ‚

The government should provide beneficial corporate tax policies as incentives for setting up industries in rural areas, where the cost of living and pay scales are much lower than in most cities. This would minimize the labor-cost advantages of low-wage countries and thereby neutralize an incentive for companies to move abroad. Loopholes in the tax structure should be eliminated, and MNCs should also be forced to pay same tax rate as domestic industries [3]. At the same time, generous tax holidays, sales tax exemptions, accelerated depreciation of industrial tools and expedited processing of industrial projects (as low-labor-cost countries now provide) would all encourage industrial investment in rural areas.

Further, rural towns and counties could budget for setting up rural colleges and universities committed to involvement in state infrastructural projects, such as roads, water and sanitation systems, renewable energy production, and expansion of broadband infrastructure, thereby fostering R&D projects at rural universities. One of the authors of this article has proposed such a scheme as part of the innovative planning of Ozark Rural University [14].

To encourage entrepreneurship, government and industries should sponsor research grants for talented research students. ¢‚¬Å“University-industry conglomerates¢‚¬ could be established between rural universities and companies to sponsor doctoral-level research, with the resultant technologies jointly owned by the conglomerates and the doctoral students and their supervisors. The doctoral entrepreneurs could recruit master¢‚¬„¢s graduates to join their companies, offering profit sharing as an incentive. This would be a win-win situation for universities as well as companies: The universities gain sponsors for R&D projects, and the companies cut the cost of R&D by carrying it out within the university environment.

Cooperative corporate ownership

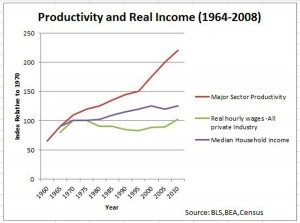

Figure 2: Productivity and real income from 1964 to 2008, indexed relative to 1970.

Sources: BLS, BEA, U.S. Census.

Wall Street, in response to investor demands, has pressured U.S. businesses to outsource high-paying manufacturing jobs offshore. We thus propose that employees become the majority shareholders in U.S. corporations, with only banks, and not wealthy Wall Street outsiders, involved in sponsoring companies. CEOs would then have to make collective managerial decisions with, and in the best interests of, their employees and hence of their companies. Hard-working employees would be rewarded with higher incomes through profit sharing.

The ¢‚¬Å“Mass ownership and cooperative management¢‚¬ of companies constitutes an economic system that is based on Mass Capitalism [13]. By eliminating outside (Wall Street) interference, this cooperative business managerial system would preserve the growth incentive, not only removing the pressure to ship jobs overseas, but eventually rendering Wall Street irrelevant and returning the country to the 99%. The wages of hard-working Americans would catch up with their productivity (see Figure 2), budget deficits would be eliminated, and the path would be set for a balanced economy; thus, this proposal comprises both micro- and macroeconomic reforms [10].

We believe this cooperative business managerial system constitutes the most innovative proposal to date for restoring the distorted supply chain and rejuvenating both regional economies and the U.S. national economy.

Figure 3: Annual U.S. income share of the top 1%, 1910 to 2010 [15].

‚

References

1. International Monetary Fund. Deconstruction and Reconstruction (1945-1958), Part 1 of 6: The postwar world.

2. World Trade Organization. From Wikipedia, The Free Encyclopedia.

3. New York State Department of Labor and EmpireState Development. September 2010. The Offshore Outsourcing of Information Technology Jobs in New York State: A report to David A. Paterson, Governor, and the Legislature of the State of New York.

4. Fowler, Meg. 2012. From Eisenhower to Obama: What the Wealthiest Americans Pay in Taxes. ABC News (Jan. 18).

5. Post¢‚¬œWorld War II economic expansion. From Wikipedia, The Free Encyclopedia.

6. We are the 99%. From Wikipedia, The Free Encyclopedia.

7. Plaza Accord. From Wikipedia, The Free Encyclopedia.

8. Lost Decade (Japan). From Wikipedia, The Free Encyclopedia.

9. Reaganomics. From Wikipedia, The Free Encyclopedia.

10. Mulay, Apek. 2013. A Failure Analysis of the U.S. Economy. Truth-out.org (March 2).

11. Webb, Justin. 2011. Don¢‚¬„¢t be distracted by Greece: Americans must also face financial facts. The Telegraph (June 25).

12. Milner, Laurie. 2011. The Suez Crisis. BBC History (March 2).

13. Sarkar, P.R. 1959. PROUT in a Nutshell. AMPS.

14. Ghista, Dhanjoo N. 2012. Ozark Rural University. West Plains Daily Quill (March 19).

15. Saez, Emmanuel. 2013. Striking it Richer: The Evolution of Top Incomes in the United States. (January 23). http://elsa.berkeley.edu/~saez/saez-UStopincomes-2011.pdf

About the authors

Apek Mulay is a senior failure analyst at Evan¢‚¬„¢s Analytical Group (EAG) in Irvine, California. He pursued undergraduate studies in electronics engineering at the University of Mumbai, India and completed his master¢‚¬„¢s degree at Texas Tech University, Lubbock. He is the author of patent ¢‚¬Å“Surface Imaging with Materials Identified by Colors¢‚¬ and has chaired technical sessions of the International Symposium for Testing and Failure Analysis. He is also a contributor to the EDFAS international journal. https://apekmulay.com

Recent Comments