I had forecasted back in 2014 about ongoing global financial crisis by end of 2015 and things are shaping up in global economy exactly as I had forecasted. I have researched in depth about US economy and US financial industry.

My research was so in depth that I could easily procure a license as financial services provider from state of California. In case you have recently been laid off from your job or have changed your jobs, it should be a reminder that your 401k account can lose its value due to coming stock market crash .

I have license from state of California and am a certified Financial Advisor with World Financial Group. I have license to sell some financial products which are not available anywhere on the internet.

I personally believe that in case of your recent layoff, November 2015 would be already very late for an enrollment. Although I am licensed only in state of California to sell these products, I have contacts of good and ethical financial advisors in other states who would be glad to help you from any part of United States.

You can view my valid license by clicking here . Your time is running out. In case you are interested in learning more about these products please do read my blog published in 2013 by clicking here .

If you are interested in any of the IULs or Rider protected Annuities which will insure the amount in your retirement account, you can shoot me an email at contact@ApekMulay.com with a short email providing your contact number and email address. I would be glad to help you personally or refer you to a suitable licensed representative in your state.

I do not recommend any products to my prospective clients unless I have myself invested into them. Besides, I look for what is in best interest of my client rather than the commission which financial advisors make as I believe in building good relationships rather than making quick money. I wish you the best and hope you protect your retirement assets with a global financial crisis on the horizon.

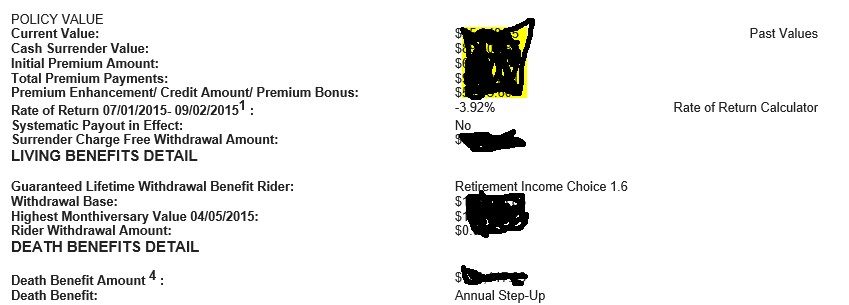

In the above option there is a guaranteed Withdrawal amount which does not fall like the 401k. Besides, There is Death benefit as it is Insurance Policy. The biggest advantage is the untold rule of bailing out Insurance companies in trouble. Hence, If Insurance company gets bailed out that means you get bailed out. That does not happen to your 401k amount when it loses its value and you take years to get back the money lost.

Recent Comments