With an expected economic depression sometime in 2014 due to end to Phony economic growth due to FED Quantitative Easing (QE) program, It is very important for middle class Americans to manage their retirement portfolio which remains insulated as much as possible from the coming stock market crash. Coming from Middle class family from India to US, I know the value of hard earned money for a person from middle class family. With my knowledge in Macro-economics and research done about US Financial industry, I believe middle class America should not just consider holding some physical Gold for security but should also balance their retirement portfolio to insure their hard earned retirement assets. I believe that there should be long term Macro-economic reforms to have majority of stocks of US corporations to be owned by majority employees in proportion to their productive contributions to the company. This would reform the current form of Crony Capitalism to a Free Market “Mass Capitalism” which would work for 100% Americans bringing about an Economic Democracy. I have chosen to exclusively publish this article on my personal website. Stay Tuned!!!!

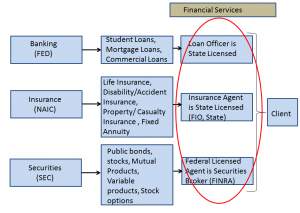

Here is a brief overview of US Financial Industry Services

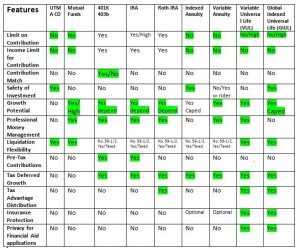

Here is a summary of the products currently offered in US Financial Industry

Tax Reforms

As Macro- economist and financial Analyst, I would like to advise you all on your tax planning.‚ While I believe in no income taxes on individuals, I believe that in the existing tax structure, one could live a better life with good tax planning. Tax planning is not tax evasion neither it is going against the rule of law. But, Tax planning is making using of certain financial products which would help take advantages of the current tax system and plan for a better and secure retirement. What do you mean by secure retirement? In current tax system and tax laws which are made by the Internal Revenue Service (IRS), individuals pay taxes on their income. These taxes are supposed to go towards running the government and setting up infra-structure.‚ With Social security going to bankruptcy because of official policies during Reagan¢‚¬„¢s presidency which enabled then Federal reserve chairman, Alan Greenspan, to raid the social security trust fund to pay for the tax cuts for the wealthy. It is no doubt that Fed chairman Alan Greenspan, who also received Knighthood from Queen Elizabeth of UK, committed a massive fraud during his tenure as Fed chairman which lasted for nearly 20 years. It is because of his fraud that today middle class America has lost their social security savings which were meant to take care of their retirement. His monetary policies have resulted in a huge disparity in wages and today just 1% of Americans control more than 97% of the wealth of US. It should be noted that the era of 1950-60 was considered as the golden era of free market capitalism. During this decade the top 1% Americans paid a highest tax rate of 92%. Yes…92%…but the annual growth in GDP was 4% year over year growth. This was because the most important engine of economic growth in any economy is high consumer purchasing power. When consumer purchasing power is high in economy, people are able to spend money and hence they can generate an economic demand. Once there is an economic demand, then the producers can produce goods to meet those demands. Why was the consumer purchasing power high during 1950-60? Since top 1% paid 92% tax rate, the taxes which included the social security taxes and payroll taxes were low on rest 99%. Hence, the purchasing power of 99% was very high and hence was the economic demand very high. What happened since Ronald Reagan¢‚¬„¢ s tax cuts is that taxes on top 1% fell up to 28% and the remaining 99% starting paying as high as 33% tax rate. Because of this the social security taxes, payroll taxes grew on 99% and hence consumer purchasing power started to decrease. To offset for that the government started an official monetary policy to lure Americans who do not have sufficient consumer purchasing power to generate an economic demand by borrowing. This is how consumer debt started to grow. Now, whenever consumer debt grows the national debt automatically grows as there are jobs lost and the government has to pay for the unemployment benefits to get re-elected. This is how National debt started to grow and today it has reached 17+ trillion USD.

Based on the above analysis, I can conclude that the tax rates are going to grow. It took 30+ years to reach to the National debt of 17+ Trillion. This debt will not be repaid overnight and taxes have to go up in future. What tax information you receive from this analysis? Since the taxes are low today and would grow tomorrow, if you plan to retire in future, you will have to pay high taxes on your tax deferred accounts. What is tax deferred account? Majority of Americans put money in their 401 K for which they get a match from their employer. In these plans, individuals do not pay taxes presently assuming that they not only get employer match but also that when they retire that tax rates would be lower. Based on the above analysis, I have proved that tax rates would be higher for next 30 years under current economic system to pay back the national debt and restore balanced economy. Hence, when you retire you should expect a huge tax bill on your tax deferred accounts. This is why I recommend you to consider options to have your money invested where taxes would be lower.

In 2008, the US congress passed a new retirement solution under the Internal Revenue Code (IRC) 7702. Under this plan, contributions are made to this retirement plan on your after tax money but the gains are withdrawn with no taxes. Sounds similar to Roth IRA? But, it is different. In Roth IRA, individuals can take money out ONLY after age 59 ‚½ years. If there is any early withdrawal, they have to pay 10% penalties to IRS. Additionally, the maximum contribution per year for Roth IRA is ONLY USD 5000. However, with plans under IRC 7702, there is higher limit on contribution and money can be withdrawn with no penalty and less than 1% interest rate any time after one year of opening this account. Additionally, This IRC 7702 retirement vehicle insures the family of the individual up to USD 500,000 to 1 million in case of death of the individual. All the growth in the account is tax free. This program could be used for funding children¢‚¬„¢s education at low loan rate of less than 1% as compared to high student loan rates currently offered by banks. All growth is tax free and hence when taxes are expected to grow up when you retire the 401k plan would pay high taxes but IRC 7702 will pay NO TAXES.

Following are the benefits of IRC 7702

IRC 7702 Benefits Summary:

¢‚¬¢ Unlimited contributions (premiums)

¢‚¬¢ Meaningful income tax-free death benefits, substantially more than any other alternative

¢‚¬¢ Tax-deferred growth of cash surrender values

¢‚¬¢ Tax-free retirement income (Surrenders to basis are income tax-free, loans are income tax-free as long as this retirement policy matures‚ and pays a death benefit )

¢‚¬¢ Tax-free loans at ANY age – There’s no 10% penalty tax for retiring before age 59‚½

¢‚¬¢ Policy death benefits and cash surrender values are assignable as collateral

¢‚¬¢ No tax penalty or tax liability when used to secure a loan.

¢‚¬¢ No required minimum distributions (RMDs) like an IRA or qualified plan, like a 401(k), 403(b), or 457 plans, so you can defer after age 70‚½.

¢‚¬¢ Tax-free income does not increase income tax liability on Social Security retirement benefits.

¢‚¬¢ Simple plan administration – No financial planning fees!

¢‚¬¢ No forms to file with the IRS (business owned policies ARE required to file forms)

¢‚¬¢ Potential asset protection from creditors and predators (varies by state, please consult with your legal counsel)

¢‚¬¢ Privacy – policy cash values are generally exempt from disclosure when applying for college financial aid

The ONLY catch is that IRC 7702 has to be purchased through a licensed agent. You should trust your financial advisor because it is very important that the advisor should look in best interest of client and not in advisor¢‚¬„¢s best interest. Hence, the advisor should have contract will several providers of IRC 7702 rather than just one. Also, the advisor is somebody whom you can trust with your money.

I have found such an advisor whom I could place trust. I would be glad to recommend if you need to find one. In either ways, I just wanted to keep up with the informative information I provide to the readers of my blog!!! Keep Visiting 🙂

Recent Comments