The US economy now seems beyond repair and thanks to the Fed’s monetary policy leading to the sub-prime crisis and no change in its policies until recently. The printing press of not only the US Fed but global central banks has been under a public scrutiny due to their monetary policies which permit pumping money into the economy while not pursuing any good reforms to ensure circulation of that currency.

With the USD taken off Gold standard in 1970s under presidency of Nixon, the US Fed has played an important role in sustaining US trade deficits and budget deficits by means of balancing those deficits by printing currency. This process exacerbated when Ronald Reagan became the US president and drastically cut the size of government. Ideally, the smaller size of government is good but this process of reducing the government size should be more gradual rather than sudden when making this transition. Hence, Reagan’s policies of pursuing supply side economic policies and trickle down economics eventually resulted in stock markets to crash in 1987.

The enforcement of Japan to sign Plaza accord in 1985 crashed the Japanese economy in 1989 but saved a total collapse of American economy in 1987. However, the Fed did not change its monetary policy which permitted Reaganomics to thrive further. So, The Fed continued its supply side economic policies and the real economic demand was completely ignored by every president post Reagan including Clinton, Bush and Obama.

Ofcourse, Fed chairman Alan Greenspan pursued flip-flops in his policies to appease to both Republican and Democratic presidents during his 20 year long tenure as Fed chair. He became the longest serving Fed chair in the history of United States and also became the Almighty God of Money such that he became the ONLY American to be knighted by Queen Elizabeth. However, As a result of Greenomics, the monetary policy continued such that real wages of Americans trailed their productivity since 1980s with lot of offshoring of manufacturing jobs and creation of huge unemployment and underemployment in US economy.

The offshoring of jobs to China turned out to be the biggest blunder of American economy. Not only China out-competed majority of American businesses but it also violated all the Intellectual Property laws in business. Besides, China also started dumping counterfeits in US supply chain. Today, As per the GAO nearly 40% of US Department of Defense supply chain is filled with defective counterfeits which has also threatened US National security along-with US economy. All this process has been enabled by US Fed’s monetary policies which permitted the wage-productivity gap to grow such that government had to do its own printing to balance the deficits. If the size of government were to be drastically cut at this stage, it would cause an excess of supply over demand and instantly collapse of the US economy causing an anarchy in the U.S.

As economist Ravi Batra ( who authored a volume in 1978 entitled THE DOWNFALL OF CAPITALISM AND COMMUNISM: A NEW STUDY OF HISTORY ) explains, For the economy to stay healthy, supply must be equal to demand, or:

Supply = Demand

With wages trailing productivity since 1981, elected officials have been following what is known as monetary policy, which tempts people into larger debts. This eliminates unemployment as spending rises to the level of supply, because now,

Supply = Demand + New Consumer Debt

The wage-productivity gap has been rising so fast that the government also had to raise its own spending and debt constantly, so that total spending matched rising supply. In this case:

Supply = Demand + New Consumer Debt + New Government Debt

Hence, Printing excess money is of no use as this money further increased the wage disparity in economy and does not circulate this printed money into the economy. As the money does not circulate in the economy, it just raises the National Debt to its unsustainable levels.

Also, Cutting size of government drastically is not a solution either as it would further the overproduction in economy. Hence, the monetary policy of the Fed should be such that Government Debt should go down, Consumer Debt should go down and Demand should start rising with rising supply to balance the supply-demand equation.

Since, Supply comes from productivity of workforce in economy and demand comes from the wages paid to workforce, only by means of ensuring that wage-productivity gap is eliminated, could the demand grow in proportion to supply without causing any consumer debt and National debt could be eventually retired over time.

As technological growth leads to exponential growth productivity in an economy, this rising productivity has to be balanced by growth in wages of employees. However, this growth in productivity also has to be balanced with the required output in the economy. Unless these reforms are undertaken, any further growth of technology is highly unsustainable and seems impractical. With real consumer demand at its lowest level since 1930 Great depression and poverty being at the highest in US economy in last 50 years, it is only common sense to pursue these reforms. It is possible to pursue these reforms and still have free markets where the size of government is small and wages automatically catch up with productivity with Mass Capitalism.

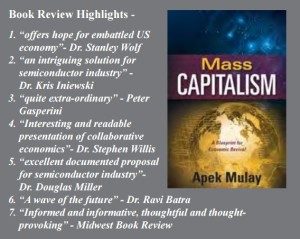

Mass Capitalism is therefore the only hope for reviving US economy from its ongoing stagnation and to usher the 4th Industrial revolution in form of Internet of things (IoT). It is a blueprint for our economic revival and perhaps only hope for Janet Yellen or her successor to secure their job. A failure to do so would worsen the economic problems and deepen the economic and political crisis in US and global economies.

ABOUT THE AUTHOR

Apekshit Mulay (Apek) is a Business and Technology Consultant at Mulay’s Consultancy Services. He is also a senior analyst and macroeconomist in US Semiconductor Industry. He has authored three volumes in three consecutive years viz. Mass Capitalism: A Blueprint for Economic Revival (2014), Sustaining Moore’s Law: Uncertainty Leading to a Certainty of IoT Revolution (2015) and How the Information Revolution remade Business, and the Economy: A Roadmap for Progress of the Semiconductor Industry (2016). His technology based monograph is entitled ‘Improving Reliability of Tungsten Plug Via on an Integrated Circuit: Process Flow in BiCMOS and CMOS Technology with Failure Analysis, Design of Experiments, Statistical Analysis and Wafer Maps‘. He pursued undergraduate studies in Electronics Engineering (EE) at the University of Mumbai, India and has completed master’s degree in EE at Texas Tech University, Lubbock, TX. Mulay authored a patent ‘Surface Imaging with Materials Identified by Colors’ during his employment in Advanced CMOS technology development team at Texas Instruments Inc. He chairs technical sessions at International Symposium for Testing and Failure Analysis (ISTFA). USCIS has approved his US permanent residency under the category of foreign nationals with extraordinary abilities in science and technologies even though he did not pursue a PhD degree in engineering or economics. He has been cited as an ‘Engineer-cum-Economist’ by superstar economist Professor Ravi Batra in his 2015 Volume ‘End Unemployment Now: How to Eliminate Poverty, Debt and Joblessness despite Congress’. He has appeared on National Radio shows, made Cover Story for Industry magazines, authored articles for newspapers as well as several reputed blogs & industry publications. He has also been invited on Television shows (because of his accurate macroeconomic forecasts) for his ideas about Mass Capitalism. He is also an entrepreneur in an e-commerce businesshttp://calcuttahandicraft.in/ which he started to envision his ideas about Mass Capitalism. His also has a very well visited personal blog www.ApekMulay.com

Recent Comments