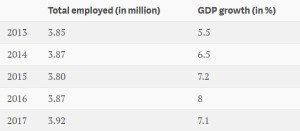

According to the a report published by the center for monitoring Indian economy, since the election of Narendra Modi as Prime Minister of India in 2014, there has been a steady growth in GDP of Indian economy. The growth in GDP has been steady for consecutive years but employment number have not been growing as fast as GDP has been growing.

Now, the question arises that how come the GDP of India has been steadily growing but real employment has been stagnating since 2013? For a country with a population of 1.25 billion, that is expected to add above 250 million to its labor force by 2050, this is an unacceptable performance from Modi government. Narendra Modi should render his resignation and apologize to the Nation for his mishandling of the economy and his hollow promises. Forget that Modi is ever going to get re-elected as Prime Minister again in 2019. The least he can do is to avoid doing any further damage to the economy.

Whether it is the failure of his approach to eliminate black money from the economy, his failure to create sufficient number jobs in economy, his failure in MAKE IN INDIA policies, failure in his Digital India approach or his failure to get rid of corruption from country’s economy, everything ties to a common sense economic policy of SUPPLY and DEMAND. A failure to focus on growth of both SUPPLY and DEMAND leads to disastrous economic performance. I have already published several books about them and some of my LinkedIn blogs are self-explanatory. But, Alas! Modi’s council of advisors cannot understand common sense SUPPLY and DEMAND.

The real estate sector of India is now showing the signs of acute crisis. The bubble is about to burst. This bubble has been growing due to supply side economic policies of Modi government. The crash now seems inevitable as the huge number of unemployed families would resort to renting over buying and hence lot more homes are expected to remain unsold. Now, Modi has come with a grand plan to pump $32 billion to recapitalize the banks of India.

This move is also bound to fail as it lacks the common sense approach of focusing on growth of both SUPPLY and DEMAND. I have explained it again, SUPPLY comes from productivity and DEMAND comes from wages. Both are necessary for growth of economy. Ignoring either of them will lead to poor job creation. My forecasts made in 2015 and 2016 based on macroeconomic analysis have come true regarding –

- Failure of Make In India

- Failure of GOLD bond introduced in 2015 Budget

- Failure of Demonetization experiment

- Creation of Real Estate Bubble (due to Repo-Rate Cuts by RBI) leading to real estate crisis

- Election of Donald Trump as US President in 2016 and its impacts on India’s prime IT sector

- India headed for US style 2008 crash

- Rising Inflation in India due to higher denomination currency notes which has gone up further with introduction of Rs 2000 denomination note by Modi government.

- Poor contribution of Indian businesses towards India’s macroeconomic growth in terms of job creation.

- Defects in Arthakranti’s proposal for eliminating black money and better approach through Mass Capitalism.

While all of above have proven to be accurate, the most interesting forecast that needs to be paid attention to is about Modi government policies are creating more Black money in India than what it can collect from Abroad. This blog was published on 4th July 2016 before Modi government executed its disastrous demonetization drive in November 2016. According to an article published (on 7 September 2017) CNBC, India tried to get the ‘black money’ out of its banking system — it ended up doing the opposite. Have you noticed that my forecasts have proven to be so accurate? In fact, Demonetization exercise has hurt the rural economies the most and even killed small businesses.

I forecast that Demonetization will also lead to higher inflation in economy due to poor circulation of currency. Narendra Modi government’s next move to infuse $32 billion into Indian economy is going to fail further. This is my next forecast. Such neo-keynesian policies do more harm than good as I have explained in my upcoming book with Business Expert Press ( it will be out by February 2018). After Infusing $32 billion into banks, I forecast that Modi government’x next proposal will be for RBI to lower its Repo rates so as to make housing market affordable as people cannot afford high interest rates. These policies are not going to revive Indian economy. Unless, the monetary policies ensure that SUPPLY an DEMAND both grow together by means of ensuring that WAGES grow in proportion to rising PRODUCTIVITY, Indian economy will continue to stagnate and eventually collapse.

Back in June 2017, I forecasted that India will have a revolutionary election in 2019 and Narendra Modi will get defeated disastrously in 2019 elections. I am not a supporter of any political party and neither do I get money from any of them for making my forecasts and my analysis. I foresee that India will have an outsider who does not belong to any political party become a prime minister in its 2019 elections. He would be a dynamic individual and would certainly look for ideas outside the system to fix the economy (unlike Narendra Modi).

I also forecast that if such a dynamic leader gets elected and is given power to change the whole economy, India might very well be the first to bring in the much needed free market economic reforms. With just 2 years left for Modi government, I think Modi government needs nothing less than a miracle at this stage to get re-elected in 2019 elections.

Author biography:

Apek Mulay is a Business and Technology Consultant at Mulay’s Consultancy Services. He is author of several books including Mass Capitalism: A Blueprint for Economic Revival, Sustaining Moore’s Law: Uncertainty Leading to a Certainty of IoT Revolution, How Information Revolution remade the Business and the Economy: A Roadmap for Progress of Semiconductor Industry and New Macroeconomics. Mulay is presently working on his next volume “New Macroeconomics in the Age of the Robot” with Business Experts Press. He pursued undergraduate studies in Electronics Engineering (EE) at the University of Mumbai, India and has completed master’s degree in EE at Texas Tech University, Lubbock, TX. Mulay is presently pursuing his second Master’s degree in Business Analytics at The University of Texas at Dallas. Mulay authored a patent ‘Surface Imaging with Materials Identified by Colors’ during his employment in Advanced CMOS technology development team at Texas Instruments Inc. He has chaired technical sessions at International Symposium for Testing and Failure Analysis (ISTFA) in 2009, 2010 and 2016. USCIS approved his US permanent residency under the category of foreign nationals with extraordinary abilities in science and technologies even though he did not pursue a PhD degree in engineering or economics. He has been cited as an ‘Engineer-cum-Economist’ by superstar economist Professor Ravi Batra in his 2015 Volume ‘End Unemployment Now: How to Eliminate Poverty, Debt and Joblessness despite Congress’. He has appeared on National Radio shows, made Cover Stories in several Industry magazines, authored articles for newspapers as well as several reputed blogs & industry publications. He has also been invited on several Television shows (because of his accurate macroeconomic forecasts) for his ideas about Mass Capitalism. He is also a social entrepreneur and an investing partner in an e-commerce business http://calcuttahandicraft.in/ which he started to envision his ideas based on collaboration that he explains in his book Mass Capitalism. His blog is www.ApekMulay.com

Recent Comments